JUN 2020 | Report Format: Electronic (PDF)

The global medical device analytical testing outsourcing market size is expected to reach USD 8.3 billion by 2025, according to a new report by Grand View Research, Inc. A large number of medical device companies outsource analytical testing operations to minimize business risks, hasten product market entry, and reduce costs. These lead to significant rise in expenditure levels and, therefore, medical device original equipment manufacturers rapidly switch to outsourcing as one of the effective cost curbing tool.

Implantable Medical Devices (IMDs) are being used increasingly in order to improve patients’ health outcome. Designers of IMDs have to balance complexity, reliability, power consumption, and costs. Consequently, companies are shifting their focus to innovation rather than noncore activities and, therefore, outsourcing these activities to launch efficient devices. All these factors are expected to increase the medical device outsourcing market over the forecast period.

In this complex ecosystem, it is necessary for equipment to provide accurate results, to have durability, and easy operation. To match these parameters, devices now have to undergo shear testing in accelerated conditions to obtain marketing approval and have competitive advantage. Conducting these in-house is matter of time, labor, and cost; outsourcing these tests helps overcome these limitations.

Further key findings from the study suggest:

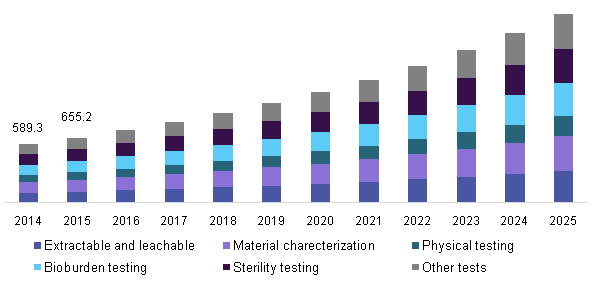

- Material characterization dominated the medical device analytical testing outsourcing market in 2015 and is likely to grow at a lucrative rate during the forecast period

- Other tests that are inclusive of cleaning, reprocessing, method development & validation, accelerated stability testing, biocompatibility, validation testing for packaging materials (container closure permeation), and transport stability are also anticipated to witness rewarding growth.

- North America is likely to witness lucrative growth which is attributed to the fact that it is one of the top manufacturing hubs of highly reliable, complex, and high-end medical devices.

- Some of the key players operating in this space are SGS SA; Toxikon, Inc.; Eurofins Scientific; Pace Analytical Services, LLC; Intertek Group plc; WuXi AppTec.; NORTH AMERICAN SCIENCE ASSOCIATES INC.; Envigo; Charles River Laboratories International Inc.; and Medical Device Testing Services