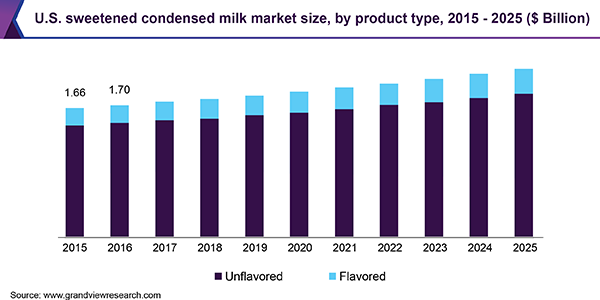

The global sweetened condensed milk market size is anticipated to reach USD 9.4 billion by 2025, according to a new report by Grand View Research, Inc., expanding at a CAGR of 3.5% over the forecast period. Long shelf life of the product, along with innovating packaging techniques, is expected to positively influence the market growth in the next few years.

Unflavored sweetened condensed milk dominated the global market in 2018. The product consumption has increased as a substitute for milk in countries like Thailand, Vietnam, and Indonesia. These countries use the product as a base for many traditional sweet dishes and beverages like teh terik. However, flavored variants such as caramel and chocolate are expected to witness substantial growth during the forecast period owing to popularity of these flavors among kids.

Can packaging type accounted for the maximum share in 2018, followed by bottles. High visibility of aluminum cans owing to its high recycling ability and low food spoilage rate is a main factor driving the market for can over the forecast period. However, consumer preference has shifted from cans to tubes owing to their convenient use and storage and introduction of milk tubes. These factors are expected to contribute to the overall growth of the market during the projected period.

Europe occupied the largest market share in 2018 owing to increase in production and consumption of sweetened condensed milk as a major beverage ingredient. Countries such as Germany, Poland, and U.K. contributed to the regional market growth. Consumption of this product is expected to reduce significantly due to its high calorie content and increasing awareness related to obesity.

However, the industry has high growth potential in Asia Pacific due to increasing consumption of the product in Vietnam and Malaysia. For instance, Vinamilk, one of the major players, is focusing on improving its brand penetration in Southeast Asia owing to huge demand for dairy products in these countries. This is expected to drive the overall market in the coming years.

To request a sample copy of this report, click the link below:

Further key findings from the report suggest:

- Tube packaging segment in sweetened condensed milk market is projected to ascend with a CAGR of 5.9% over the forecast period owing to longer shelf life and easy storage of the tube

- Eagle brand, one of the most popular brands of sweet condensed milk, launched caramel and chocolate flavored, along with a series of recipes. The flavors were launched during the holiday season in 2015 to improve product consumption and increase product sales

- Fraser & Neave Holdings Bhd (F&NHB) launched Milk Stix and Squeeze Tube, Malaysia’s first full cream sweetened condensed milk in such packaging to increase product sales.

Grand View Research has segmented the global sweetened condensed milk market by product type, packaging type, and region:

Sweetened Condensed Milk Product Type Outlook (Revenue, USD Million, 2015 - 2025)

- Flavored

- Unflavored

Sweetened Condensed Milk Packaging Type Outlook (Revenue, USD Million, 2015 - 2025)

- Cans

- Bottles

- Tubes

- Other