Industry Insights

The growing demand for the product through online distribution channels make it easier for smaller wineries to reach customers across the U.S. thereby encouraging investors to enter this market. In 2016, over 760 new establishments have opened in the U.S. indicating favorable economic conditions, increasing the investments in the industry.

The increasing availability of the product is the other major factor growing consumer preference for the product. Nail salon, movie theaters, bookstores and even car washing stations along with some grocers such as Kroger, Wegmans, and Whole Foods serve food and on-premise wine in stores thereby promoting the consumption of the product.

Automated machinery is used at various stages of the harvesting and production processes, especially at larger producing facilities. Advancements in agriculture technology (ag-tech) to use water and electricity efficiently, use of drone aircraft to irrigate crops and thermal & GPS sensors to collect data on all aspects of grapevine physiology is likely to enhance the product quality.

To view summary of U.S. Wine Market Report, click the link below:

Major raw materials required for the manufacturing includes grapes and water. In addition, manufacturers also use berries, apples, cherries, palm, rice, colors, flavors, sugar, yeast, enzymes and range of other products in production. Premium quality of grapes is used as it determines the taste of the product on account of which, raw material costs equal to about 40% of overall industry revenue.

Fluctuations in grape supplies, oversupply or undersupply, caused by inclement weather, agriculture policy changes, and other factors have a significant impact on the operational costs. Producers also face challenges owing to unfavorable currency exchange rates and high logistics and raw material import costs.

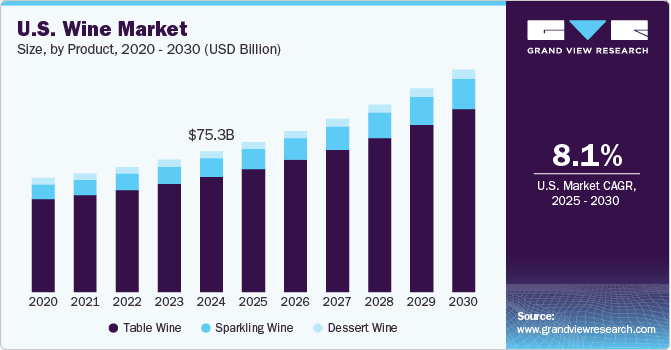

Product Insights

Dessert wines are sweet and are popularly referred as pudding wines. Dessert blends made from grapes with sufficient sugar to spare is strong and sweet, which complements the taste of the desserts on account of which the per capita consumption of the product is increasing substantially in the U.S.

Sparkling wine is the fastest-growing segment in the industry, indicating a significant increase in consumption of champagne and prosecco from 2014 to 2017. The manufacturers have introduced a wide range of low-cost products in the segment category that has played a major role in driving the segment growth.

Distribution Insights

Wineries have increased their sales to major supermarket chains by improving the quality and value of their private-label selections. The share of grocery retailers in the overall sales is growing as a large number of grocers offer inexpensive bottles of private-label blends, which are produced exclusively for a single retailer and sold under the store’s brand rather than the winery’s brand name.

E-commerce and other direct-to-consumer sales segment are expected to grow significantly in the country on account of favorable changes in the state regulations related to online sales. Small-scale producers in the country are expected to reach a wider audience for their blends through the internet, which is expected to gain share, bypassing the distributors share.

Country Insights

The U.S. exports to major markets including Canada, UK, Hong Kong, Japan, and Germany have reached USD 1.62 billion in 2016. California accounted for over 90% of the export revenue on account of the quality, diverse styles, value and environmental stewardship in its alcohol production.

Table wines are regularly consumed varieties and majorly distributed through off-trade distribution owing to the low cost of product associated with the channel. Chardonnay is the largest selling blend accounting for 20% volume share, followed by Cabernet Sauvignon and other red blends including pinot grigio/gris, pinot noir, sweet reds, Merlot, and white zinfandel/blush.

Download U.S. Wine Market Report, click the link below:

Report Scope

| Attribute | Details |

| Base year for estimation | 2017 |

| Actual estimates/Historical data | 2014 - 2017 |

| Forecast period | 2018 - 2025 |

| Market representation | Volume in million liters, revenue in USD billion and CAGR from 2017 to 2025 |

| Country scope | U.S. |

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors and trends |

| 15% free customization scope (equivalent to 5 analyst working days) | If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization |