The global flame arrestor market size was valued at USD 2.61 billion in 2023 and is expected to grow at a CAGR of 4.5% from 2024 to 2030. A flame arrestor is a device designed to allow gas to pass through while stopping a flame, thereby preventing a larger fire or explosion. Increased safety regulations requiring flame arrestors across various industries are a significant driver behind the market growth. In addition, the growing awareness of workplace safety highlights the importance of flame arrestors. Thus, strict standards mandated by regulatory authorities compel businesses to enhance their safety infrastructure, driving the growth of the market.

To learn more about this report, request a free sample copy

Governments and regulatory bodies are imposing stringent guidelines to prevent fire hazards and explosions, necessitating the use of flame arrestors. For instance, in January 2023, the U.S. Consumer Product Safety Commission (CPSC) announced the requirement of flame mitigation devices such as flame arrestors on gas cans and other portable fuel containers. The new mandatory safety standard went into effect in July 2023. Congress mandated the agency to implement rules to safeguard customers under the Portable Fuel Container Safety Act (PFCSA) of 2020. This regulatory push ensures safer handling and storage of flammable liquids and drives innovation and investment in flame arrestor technology to meet the new safety requirements, thereby fueling market growth.

Advancements in materials and manufacturing processes are leading to the development of more efficient and durable flame arrestors. Innovations such as corrosion-resistant materials and improved design structures are enhancing the performance and lifespan of flame arrestors. These technological improvements are driving market growth as industries seek reliable and long-lasting safety solutions. Additionally, the integration of smart technologies for real-time monitoring and maintenance is emerging as a key trend in the market.

Furthermore, flame arrestors prevent explosions and increase safety. They also provide benefits such as modest maintenance and regulatory compliance. For instance, flame arrestors are mandated by numerous regulatory bodies and standards, including the Occupational Safety and Health Administration (OSHA), the National Fire Protection Association (NFPA), and the European Union’s ATEX directive. Implementing flame arrestors enables businesses to comply with these regulations, helping them avoid penalties and fines. Thus, increasing demand for flame arrestors in industries that handle flammable liquids and gases, such as chemical, oil and gas, and pharmaceutical industries, is expected to drive the market growth from 2024 to 2030.

A growing demand for flame arrestors in the mining industry is a significant market trend. Flame arrestors are utilized in the mining sector to prevent fires and explosions in equipment that manages flammable gases and liquids, such as diesel fuel. While flame arrestors offer crucial safety benefits, they also come with some drawbacks. They can cause pressure drops and flow restrictions in pipelines, potentially reducing the efficiency of fluid or gas transport, which could hamper the market’s growth.

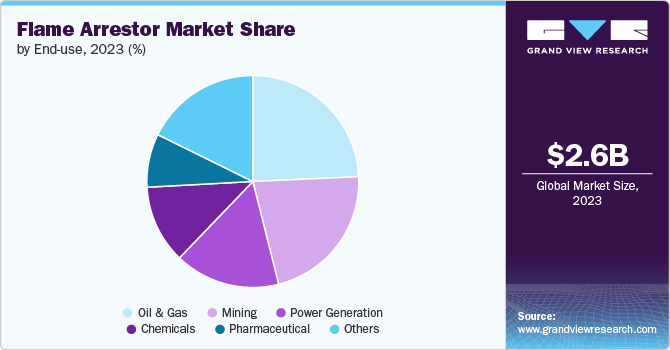

End Use Insights

The oil & gas segment dominated the market with the largest revenue share in 2023. The oil & gas industry is one of the largest consumers of flame arrestors, driven by the need for stringent safety measures in exploration, production, and transportation activities. The rise in global energy demand is leading to increased exploration and production activities, thereby fueling the demand for flame arrestors. Additionally, the development of new oil and gas fields, particularly in offshore and remote locations, is creating opportunities for market growth.

To learn more about this report, request a free sample copy

The chemicals segment is projected to witness significant growth from 2024 to 2030. Chemical processing industries use flame arrestors in their safety protocols to protect against combustible gases and vapors. These devices are used to prevent the spread of flames and explosions in distillation columns, reactors, and other equipment managing flammable chemicals. Thus, the rising adoption of flame arrestors by chemical companies to protect equipment, workers, and chemical processing plants from harm and ensure regulatory compliance with safety standards is boosting the segment’s growth.

Regional Insights

North America flame arrestor market is expected to witness steady growth from 2024 to 2030. The increasing safety regulations and the expansion of the oil and gas industry across countries such as the U.S., Canada, and Mexico are major factors driving the market growth. In addition, enhanced awareness of industrial safety standards and the need to prevent explosions in hazardous environments are additional key factors propelling market demand.

U.S. Flame Arrestor Market Trends

The flame arrestor market in the U.S. is expected to grow at a significant growth rate from 2024 to 2030. This growth can be attributed to factors such as technological advancements in flame arrestor designs, the country’s significant investments in infrastructure and industrial projects, and the vast presence of flame arrestor manufacturers and distributors.

Asia Pacific Flame Arrestor Market Trends

The flame arrestor market in Asia Pacific dominated the global industry in 2023 and accounted for a 34.3% share of the global revenue. Emerging economies in the region are experiencing rapid industrialization, leading to increased demand for flame arrestors. The expansion of industries such as petrochemicals, mining, and power generation in countries such as China, India, and Japan are contributing to market growth. As these economies develop, there is an increased focus on safety standards, further boosting the adoption of flame arrestors.

Europe Flame Arrestor Market Trends

The flame arrestor market in Europe is expected to grow at a notable CAGR from 2024 to 2030. The growth of the chemical and petrochemical industries, coupled with rising environmental concerns, is driving the demand for advanced flame arrestors in the region. In addition, growing investments in renewable energy projects and industrial infrastructure are further contributing to the wider adoption of flame arrestors in the region.

Key Flame Arrestor Company Insights

Key players operating in the flame arrestor market include Emerson Electric Co., The Protectoseal Company, L&J Technologies, Elmac Technologies, Braunschweiger Flammenfilter GmbH, Westech Industrial Ltd., Essex Industries, Inc., Cashco, Arm-Tex, and FLUIDYNE INSTRUMENTS PVT. LTD. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Flame Arrestor Companies:

The following are the leading companies in the flame arrestor market. These companies collectively hold the largest market share and dictate industry trends.

- Emerson Electric Co.

- The Protectoseal Company

- L&J Technologies

- Elmac Technologies

- Braunschweiger Flammenfilter GmbH

- Westech Industrial Ltd.

- Essex Industries, Inc.

- Cashco

- Arm-Tex

- FLUIDYNE INSTRUMENTS PVT. LTD

View a comprehensive list of companies in the flame arrestor Market

Global Flame Arrestor Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flame arrestor market report based on type, application, end use, and region.

- Type Outlook (Revenue, USD Million, 2018–2030)

- Inline Arrestor

- End-of-line Arrestor

- Application Outlook (Revenue, USD Million, 2018–2030)

- Storage Tank

- Pipeline

- Incinerator

- Ventilation System

- Others

- End Use Outlook (Revenue, USD Million, 2018–2030)

- Oil & Gas

- Chemicals

- Pharmaceutical

- Mining

- Power Generation

- Others

- Regional Outlook (Revenue, USD Million, 2018–2030)

- North America

- U.S.

- CanadaM

- Mexico

- Europe

- Germany

- UK

- France

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Middle East & Africa

- UAE

- Kingdom of Saudi Arabia

- South Africa