Germany Pet Food Market Size & Trends

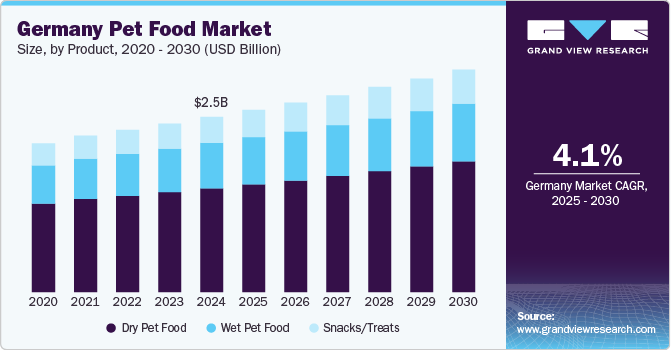

The Germany pet food market size was estimated at USD 2.53 billion in 2024 and is expected to grow at a CAGR of 4.1% from 2025 to 2030. The market is witnessing notable growth, largely driven by the increasing humanization of pets. German consumers are increasingly treating their pets as family members, significantly impacting purchasing behavior. Pet owners are no longer content with basic nutrition; they opt for high-quality, premium food products that mirror human dietary preferences. As a result, natural, organic, and additive-free pet foods have become mainstream choices, reflecting a broader cultural shift toward wellness and care.

Consumer Insights

The humanization of pets increasingly influences consumer behavior around pet food in Germany. Many Germans consider their pets as a part of their families, and this emotional bond directly affects how they shop for pet food. Rather than opting for standard or low-cost products, consumers are now choosing premium, nutrient-rich food that mimics the quality of their own diets. This shift is especially pronounced among younger pet owners and urban populations, who tend to be more health-conscious and willing to spend more on high-quality pet nutrition.

Product Insights

Dry pet food accounted for a revenue share of 59.5% in 2024. The demand for dry pet food in Germany is growing due to its convenience, longer shelf life, and cost-effectiveness compared to wet or fresh alternatives. Many pet owners prefer dry food for its ease of storage, portion control, and dental health benefits, as the kibble helps reduce plaque and tartar buildup. Furthermore, the growing availability of nutritionally balanced and specialized dry formulas, such as grain-free, high-protein, and breed-specific options, is attracting health-conscious consumers seeking tailored nutrition for their pets.

Pet Type Insights

Pet food for dogs accounted for a revenue share of 59.5% in 2024. Dog pet food sales in Germany are growing rapidly due to the rising dog ownership across the country and the increasing tendency to treat dogs as family members. Owners are emphasizing their dogs’ health and nutrition more, driving demand for high-quality, tailored food products that meet specific dietary needs and life stages. The popularity of premium, natural, and functional dog food, such as grain-free, hypoallergenic, and breed-specific formulas, is also contributing to market growth. Furthermore, dog food’s wide availability through retail and online channels has made it more accessible than ever.

Key Germany Pet Food Company Insights

Pet food manufacturers in the Germany region are increasingly adopting advanced food processing technologies to improve product quality, flavor, and nutritional content. Techniques such as vacuum frying, air frying, and freeze-drying are used to preserve ingredients’ natural qualities and nutrients while minimizing oil content. In addition, manufacturers are incorporating innovative packaging solutions, such as resealable and biodegradable options, to enhance convenience and sustainability. Customization is also gaining momentum, with brands offering diverse seasoning blends, organic choices, and personalized snack/treat packs to meet the varied preferences of pet owners.

Key Germany Pet Food Companies:

- The J.M. Smucker Company

- Nestlé Purina

- Mars, Incorporated

- LUPUS Alimento

- Total Alimentos

- Hill’s Pet Nutrition, Inc.

- General Mills Inc.

- WellPet LLC

- The Hartz Mountain Corporation

- Diamond Pet Foods

Germany Pet Food Market Report Segmentation

This report forecasts volume & revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Germany pet food market report based on product, pet type, category, distribution channel, and region:

- Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018–2030)

- Wet Pet Food

- Dry Pet Food

- Snacks/Treats

- Pet Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018–2030)

- Cats

- Dogs

- Others

- Category Outlook (Revenue, USD Million; Volume, Kilo Tons; 2018–2030)

- Traditional Pet Food

- Specialist Veterinary Nutrition

- Cats

- Dogs

- Others

- Distribution Channel Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018–2030)

- Supermarkets & Hypermarkets

- Convenience Stores

- E-commerce

- Pet Specialty Stores

- Others