September2024 | Report Format: Electronic (PDF)

Preclinical Imaging Market Growth & Trends

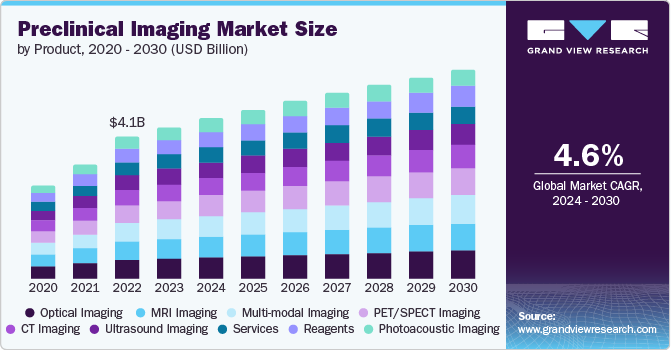

The global preclinical imaging market size is expected to reach USD 5.96 billion by 2030, registering a CAGR of 4.55% from 2024 to 2030, according to a new report by Grand View Research, Inc. Heavy investments in research and development are encouraging research projects worldwide. As a result, the demand for preclinical imaging is steadily increasing. Pharmaceuticals, biotechnology, life sciences, medical devices, and cosmetics are wide application areas, where imaging modalities are widely used in research and development. Furthermore, veterinary hospitals and educational institutions also create an additional demand for this market.

Nuclear medicine techniques (primarily, positron emission tomography (PET) and single photon emission computed tomography (SPECT)), optical imaging, micro-computed tomography (CT), micro magnetic resonance imaging (MRI), Photoacoustic tomography (PAT), and ultrasound are the most suitable modalities for small-animal in vivo imaging applications. Each modality has its own set of benefits and drawbacks. The multimodality devices designed to give complementary information on the pathophysiological process under research have rapidly gained popularity, seeking to overcome the inherent limits of each imaging modality. The combination of high-resolution modalities such as micro-CT and micro-MRI with highly sensitive techniques that provide functional information like micro-PET or micro-SPECT is expected to broaden the horizons of research in key areas like infection, oncology, cardiology, and neurology, contributing not only to the understanding of disease underlying mechanisms but also providing efficient and unique tools for evaluating new chemical entities and candidate drugs, thus boosting the global market growth.

The global market’s prominent competitors are undertaking different initiatives for enhancing their product portfolio with novel product launches and enhancing their manufacturing capacity. For instance, In February 2023, at the 75th National Conference of the Indian Radiological and Imaging Association, FUJIFILM India announced the development of its equipment and service offerings. The company demonstrated cutting-edge diagnostic tools at the event in Amritsar from February 2–5, 2023. The recently released MRI machine APERTO Lucent Non DICOM printer APEOS and the ultrasound devices Arietta 650 DeepInsight and Arietta 850 DeepInsight are all components of the new portfolio. A smartphone application for assistance and guidance called “FUJIFILM Connect” was additionally released by the company.

Moreover, the advancements in the high-throughput ultrasound imaging system used in the application of cancer research and studies boost the market. In April 2022, the Vega imaging system, a handheld ultrasound system with fully automated technology and high-throughput capacity, which can speed up non-invasive clinical research and drug discovery in the fields of cancer, kidney and liver disease, and heart disease, was launched by PerkinElmer as an aspect of the company’s announcement of a broadening of its live image analysis. The use of non-invasive imaging methods is encouraged since they reduce the need for invasive operations while minimizing animals’ discomfort to a minimum. Preclinical imaging techniques have been adopted as a result of this ethical consideration.

Request a free sample copy or view report summary:

Preclinical Imaging Market Report

Preclinical Imaging Market Report Highlights

- Based on product, The optical imaging segment held the largest market share of 13.6% in 2023 owing to its wide usage in small animal imaging and new drug discovery projects

- The research & development segment captured the largest market share in 2023 owing to the technological advancements and improved healthcare infrastructure

- In terms of end-use, the pharma and biotech companies segment captured the largest market share of 40.0% in 2023. The constant research activities and innovation of products in pharma & biotech companies have led market players to increase their product sales, driving market growth

- Based on region, North America held the largest revenue share 29.75% in 2023 owing to the well-developed research infrastructure, a large number of preclinical projects, and higher adoption rates of technically advanced devices in the region can be attributed to this share

- Major players in the industry are focusing on the launch of advanced technology and features such as artificial intelligence-enabled systems

Preclinical Imaging Market Segmentation

Grand View Research has segmented the global preclinical imaging market on the basis of on product, application, end-use, and region:

Preclinical Imaging Product Outlook (Revenue, USD Million, 2018–2030)

- CT Imaging

- MRI Imaging

- PET/SPECT Imaging

- Multi-modal Imaging

- Optical Imaging

- Ultrasound Imaging

- Photoacoustic Imaging

- Reagents

- Services

Preclinical Imaging Application Outlook (Revenue, USD Million, 2018–2030)

- Research And Development

- Drug Discovery

Preclinical Imaging End-use Outlook (Revenue, USD Million, 2018–2030)

- Pharma And Biotech Companies

- Research Institutes

- Others

Preclinical Imaging Regional Outlook (Revenue, USD Million, 2018–2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- Thailand

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

List of Key Players in the Preclinical Imaging Market

- Bruker Corporation,

- Siemens A.G.

- General Electric(GE)

- TriFoil Imaging

- PerkinElmer, Inc.

- FUJIFILM SonoSite

- Mediso Ltd.

- Agilent Technologies

- MILabs B.V.

- MR Solutions

- Molecubes