May 2020 | Report Format: Electronic (PDF)

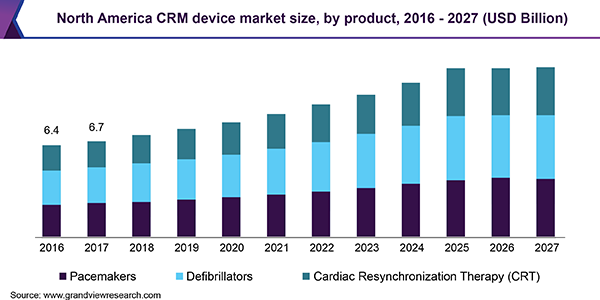

The global cardiac rhythm management devices market size is anticipated to reach USD 34.1 billion by 2027, as per a new report by Grand View Research, Inc., registering a CAGR of 6.8% over the forecast period. The market has shown constant growth in the adoption of cardiac rhythm management (CRM) devices owing to increasing prevalence of cardiovascular disorders. Cardiovascular Diseases (CVDs) are one of the main causes of mortality in the U.S.; one-fourth of all deaths in the country are the result of CVDs. Stroke and ischemic heart disease account for more than 80% of all cardiac deaths worldwide. According to CDC in 2017, CVDs were responsible for about 800,000 lives lost in the U.S.

Reimbursement policies, such as those introduced by the U.S. Medicare system, are among the major factors boosting the CRM market. Medical device companies now provide new product platforms that are covered under reimbursement programs, which benefit cardiac patients. Reimbursement can be availed for devices such as biventricular pacemakers, single chamber, and dual chamber.

Revolutionary technological progresses are rapidly transforming the CRM devices market, offering lucrative growth potentials. Increase in R&D expenditure and new product launches by leading firms have further fueled market growth. For instance, Biotronik’s Rivacor and Acticor, both high voltage CRM devices for cardiac arrhythmia treatment, gained FDA approval in March 2019. In May that year, Medtronic launched the CareLink SmartSync Device Manager.

Some of the major players in the market for cardiac rhythm management solutions are Physio-Control, Inc. (Stryker); Medtronic; St. Jude Medical; and Boston Scientific Corporation, which account for a significant share in the market owing to their extensive product offerings. Industry players are striving to gain market penetration and adopting strategies such as new product launch and M&As. In March 2019, Zoll acquired Golden Hour Data Systems to optimize its operations with a complete suite of business solutions.

To request a sample copy or view summary of this report, click the link below:

www.grandviewresearch.com/industry-analysis/cardiac-rhythm-management-devices-industry

Further key findings from the study suggest:

- By product, defibrillators for cardiac rhythm management held the dominant share due to their high acceptance in countries such as U.S., China, and India

- Implantable cardioverter defibrillators formed the largest sub-segment by product in 2019 owing to better patient outcome

- Among external defibrillators for cardiac rhythm management, the manual variants generated the highest revenue owing to associated benefits such as converting arrhythmia or tachycardia to a normal heartbeat

- Physio-Control, Inc. (Stryker); Medtronic; St. Jude Medical; and Boston Scientific Corporation are some of the major participants in CRM devices market due to their extensive product offerings and strong regional presence.