Adipic Acid Market Revenue Reach $8.0 Billion | Global Industry Report Forecast 2024 | Market Research Report

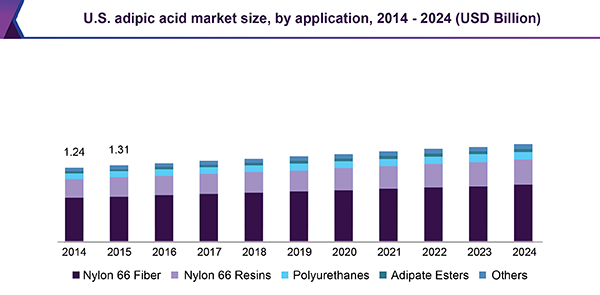

The global adipic acid market size is projected to reach USD 8.0 billion by 2024, according to a new report by Grand View Research, Inc. The global market is projected to expand at a CAGR of 4.7% during the forecast period. Increasing product demand from the automobile industry for the manufacturing of lightweight vehicles is a prime factor responsible for the market.

Growth of the nylon 66 market is likely to have a positive impact on the adipic acid market demand in India. Nylon 66 accounts for a majority share in adipic acid’s demand. Rapidly growing consumer electronics industry in Asia is also one of the major factors contributing toward the industry development.

The Asia Pacific region holds excellent potential for the market penetration as adipic acid’s supply in this region is disrupted owing to low spot prices.

Moreover, the region has business-friendly atmosphere and is close to the nylon and polyurethane manufacturing industry. The product demand in this region is expected to reach 1,551.8 kilo tons by the end of the forecast period.

Adipic acid manufacturers are currently strategizing to physically position themselves between raw material supply hub and end-use industries to attain optimum growth and profit margins. Major adipic acid manufacturers and distributors operating around the globe include Asahi Kasei Corporation, BASF SE, Invista, Lanxess AG, and Ascend Performance Materials LLC.

“Read Report Summary, Toc, Market Segmentation, Research Methodology, Request a Free Sample“ Click the link below:

Further key findings from the study suggest:

- Global consumption for adipic acid was estimated to be 2,986.4 kilotons in 2016

- Oil price shocks in this industry are extremely evident as the economics of low crude oil prices have trickled down to the adipic acid value chain during 2015–2017

- Adipic acid manufacturers are capitalizing on cheap, abundant raw material currently present in the market. However, this is giving rise to overutilization in the industry further bringing down the prices

- Polyurethane is likely to emerge as the second fastest-growing segment over the forecast period accounting for a market share of 15.98% by 2025

- The market size estimated for adipic acid consumed for manufacturing nylon 66 fiber and resins was estimated to be around 2,600-kilo tons in 2016.

Grand View Research has segmented the global adipic acid market on the basis of application and region:

Adipic Acid Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014–2024)

- Nylon 66 Fiber

- Nylon 66 Resins

- Polyurethanes

- Adipate Esters

- Others