Germany Accident Insurance Market Trends

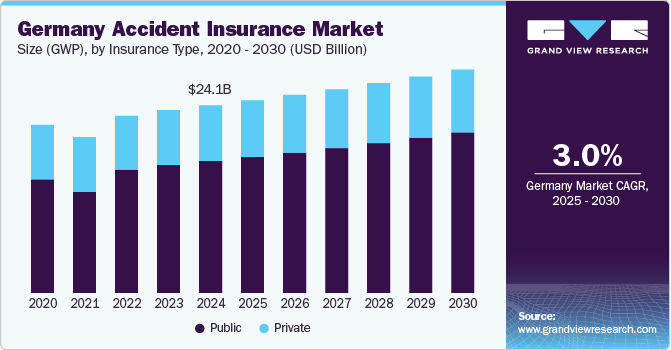

The Germany accident insurance market size in terms of Gross Written Premium (GWP) was estimated at USD 24.11 billion in 2024 and is projected to grow at CAGR of 3.0% from 2025 to 2030. And the market size in terms of New Business Premium (NBP) was estimated at USD 2.33 billion in 2024 and is expected to expand at a CAGR of 2.4% from 2025 to 2030.

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The X-axis represents the level of market concentration, ranging from low to high. The Y-axis represents various market characteristics, including industry competition, degree of innovation, level of mergers & acquisition activities, regulatory impact, product substitutes, and regional expansion. For instance, the Germany accident insurance market is fragmented, The German accident insurance markets operate under a highly competitive and fragmented structure. The level of innovation is moderate, while the influence of regulations on the industry and the extent of partnership and acquisition activities is high. However, the geographic expansion of the industry remains moderate.

Insurance Type Insights

Public insurance accounted for the largest revenue share of 70.32% in 2024. In addition, this segment is expected to grow at the fastest CAGR during the forecast period. This growth is attributed to the presence of statutory accident insurance institutions, requiring employers to provide coverage for their employees. This comprehensive coverage is managed by Berufsgenossenschaften (professional associations) and Unfallkassen (accident funds), which are industry-specific statutory insurance carriers. Moreover, statutory accident insurance covers many risks associated with occupational accidents, commuting accidents, and occupational diseases, leading to high premium levels to fund medical treatment, rehabilitation, and pension payments. The system operates on a pay-as-you-go basis, with premiums determined based on industry-specific risk classifications and prior claims history, ensuring sustainability and revenue adequacy. Unlike private accident insurance, which remains voluntary and complementary, public accident insurance benefits from legal enforcement and scale economics.

Policy Type Insights

The corporate policy segment held the largest revenue share of 68.84% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The corporate accident insurance consists of employer-sponsored accident insurance policies for workplace coverage, group insurance contracts, and corporate liability accident protection. These policies are renewed each year and are included in larger corporate insurance portfolios, which helps insurers maintain stable, recurring revenues. For instance, ERGO has a strong focus on corporate accident insurance, covering employer-backed policies and industrial accident solutions.

Key Germany Accident Insurance Company Insights

Key players operating in the Germany accident insurance market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Germany Accident Insurance Companies:

- Allianz SE

- Debeka Krankenversicherungsvere A.G.

- Generali Deutschland

- R+V Versicherung AG

- AXA Konzern AG

- ERGO

- DKV

- Signal Iduna

Germany Accident Insurance Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Germany accident insurance market report based on insurance type, policy type, and distribution channel.

- Insurance Type Outlook (Revenue, USD Billion, 2018–2030)

- Germany Accident Insurance Market (Gross Written Premiums (GWP))

- Public

- Corporate Policy

- Retail Policy

- Germany Public Accident Insurance Market (GWP), by Distribution Channel Outlook (Revenue USD Billion, 2018–2030)

- Employer-based Enrollment

- Self-enrollment for Special Groups

- Private

- Corporate Policy

- Retail Policy

- Germany Private Accident Insurance Market (GWP), by Distribution Channel Outlook (Revenue USD Billion, 2018–2030)

- Single Company Broker

- Multi-Company Broker

- Credit Institutions

- Direct Sales

- Other Sales

- Germany Accident Insurance Market (New Business Premiums (NBP))

- Public

- Private

- Policy Type Outlook (Revenue USD Billion, 2018–2030)

- Corporate Policy

- Retail Policy

- Distribution Channel Outlook (Revenue USD Billion, 2018–2030)

- Traditional Distribution Channels

- Digital/ Online Distribution Channels