December 2024 | Report Format: Electronic (PDF)

Demi-fine Jewelry Market Growth & Trends

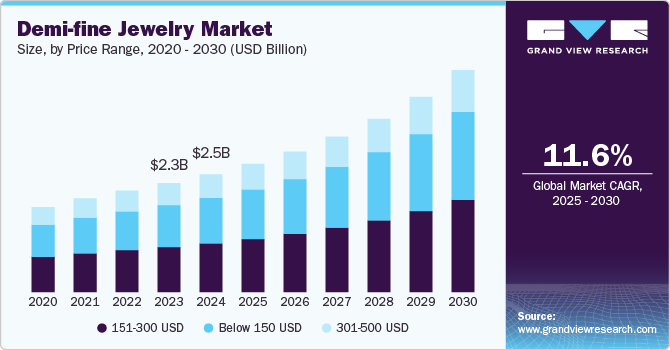

The global demi-fine jewelry market size is anticipated to reach USD 4.6 billion by 2030, according to a new report by Grand View Research, Inc. The market is anticipated to grow at a CAGR of 11.6% from 2025 to 2030. The market is driven by a combination of evolving consumer preferences, a rising interest in sustainable and ethical practices, and the increasing influence of social media and e-commerce. Demi-fine jewelry, typically characterized by its use of high-quality materials such as sterling silver, gold vermeil, and semi-precious stones, strikes a balance between affordable fashion and luxury. This unique positioning appeals to a broad demographic, particularly younger consumers who seek trendy yet accessible jewelry options without the hefty price tag of fine jewelry.

Consumers today are increasingly looking for jewelry that reflects their styles, sentiments, and life experiences. Brands that offer made-to-order pieces, engraving options, or customizable components are gaining a competitive edge. In addition, the trend towards minimalism contributes to the appeal of demi-fine collections, as consumers lean towards simpler, more versatile designs that can be layered or worn on their own for various occasions. This personalization trend not only enhances emotional connections with the products but also encourages repeat purchases as consumers seek to expand their collections.

The rise of social media and influencer marketing has also played a pivotal role in shaping the demi-fine jewelry landscape. Platforms like Instagram, Pinterest, and TikTok have created new avenues for brands to showcase their designs and engage directly with consumers. Influencers and micro-influencers, in particular, have become key players in promoting demi-fine jewelry, often highlighting their favorite brands and styles through authentic storytelling. This grassroots approach has resonated well with younger generations, who prioritize community and authenticity in their purchasing decisions. As a result, brands that can leverage social media effectively are seeing higher visibility and sales, leading to increased competition in the market.

As awareness of environmental issues and ethical consumption rises, consumers are seeking out brands that prioritize eco-friendly practices and sustainable sourcing of materials. The growing awareness around ethical sourcing of materials such as recycled metals and lab-grown gemstones aligns with the values of socially conscious buyers. As a result, many demi-fine jewelry brands are incorporating sustainable narratives into their marketing strategies, appealing to eco-conscious consumers who seek not only aesthetically pleasing pieces but also those that reflect their ethical standards.

Request a free sample copy or view report summary:

Demi-fine Jewelry Market Report

Demi-fine Jewelry Market Report Highlights

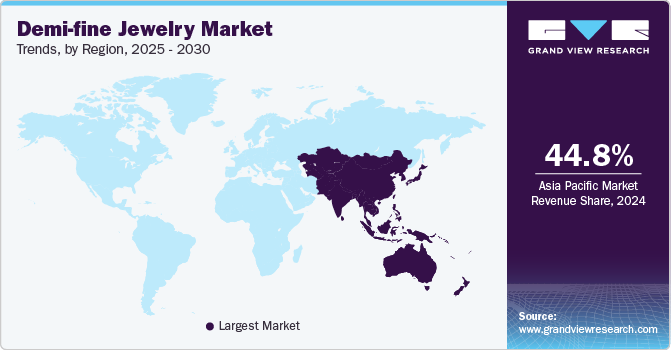

- Asia Pacific is expected to grow at a considerable CAGR over the forecast period from 2025 to 2030. Cultural factors play a significant role in shaping the market across the Asia Pacific. Traditional motifs and artisanal craftsmanship are increasingly being blended with modern designs, appealing to consumers who value heritage and contemporary aesthetics alike. Enhanced marketing efforts through social media and celebrity endorsements have amplified brand recognition among younger consumers.

- The below 150 USD segment is estimated to grow at a substantial CAGR over the forecast period. This segment offers tremendous potential, particularly as millennials and Gen Z consumers gravitate towards affordable luxury. This demographic values versatility and personalization, often seeking pieces that can easily transition from casual to formal settings. This trend has led to a surge in brands focusing on creating trendy, on-trend jewelry that caters to the desire for fashion-forward items at accessible price points.

- Women’s demi-fine jewelry is estimated to grow at a substantial CAGR over the forecast period, driven by a rising inclination towards personal expression and individuality, prompting women to seek jewelry pieces that reflect their unique style. As fashion becomes increasingly democratized, women are not just looking for traditional gold or diamond pieces; they are exploring a diverse range of materials, including colorful gemstones, sustainable options, and artisanal designs that offer both uniqueness and accessibility.

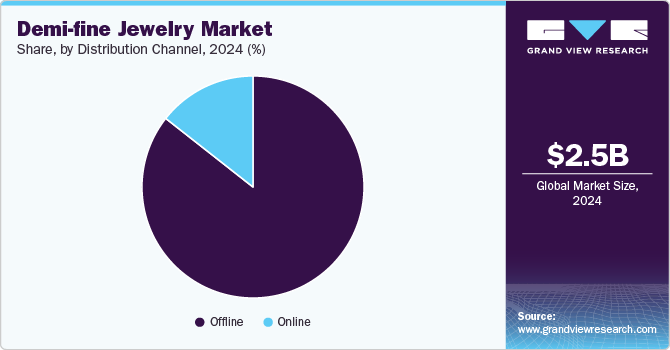

- The sales of demi-fine jewelry through online channels are estimated to grow at a substantial CAGR over the forecast period. The proliferation of mobile shopping has made it easier for consumers to browse and purchase jewelry on the go, further propelling demand in the online segment. This shift is also supported by the increasing consumer confidence in online shopping by making improvements in website security and customer service, hassle-free return policies, and virtual try-on technologies.

Demi-fine Jewelry Market Segmentation

Grand View Research has segmented the global demi-fine jewelry market report based on price range, application, distribution channel, and region:

Demi-fine Jewelry Price Range Outlook (Revenue, USD Million, 2018–2030)

- Below 150 USD

- 151–300 USD

- 301–500 USD

Demi-fine Jewelry Application Outlook (Revenue, USD Million, 2018–2030)

- Women

- Men

Demi-fine Jewelry Distribution Channel Outlook (Revenue, USD Million, 2018–2030)

- Offline

- Online

Demi-fine Jewelry Regional Outlook (Revenue, USD Million, 2018–2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- France

- Germany

- Spain

- Italy

- Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- South Korea

- Latin America

- Brazil

- Middle East & Africa

- Saudi Arabia

List of Key Players in the Demi-fine Jewelry Market

- Otiumberg Limited

- Missoma Limited

- Edge of Ember

- Catbird

- Astley Clarke Limited

- WWAKE, Inc.

- Loren Stewart

- Monica Vinader Ltd.

- Natasha Schweitzer

- Sarah & Sebastian Pty Ltd