November 2024 | Report Format: Electronic (PDF)

U.S. Prefabricated Steel Market Growth & Trends

The U.S. prefabricated steel market size is expected to reach USD 25.37 billion by 2030, expanding at a CAGR of 5.7% from 2023 to 2030, according to a new report by Grand View Research, Inc. The growth is attributed to the benefits of prefabricated structures, such as low cost, shorter times, enhanced quality, and ease of relocation. Prefabrication refers to producing building components or structures at a factory or manufacturing site and assembling them on a job site. The manufacturers are engaged in off-site construction, module fabrication, roof manufacturing, and panel fabrication. They take care of site preparation simultaneously, which involves mobilization, demolishing, excavation, and footing casting.

The simultaneous operations at off-site and on-site locations save significant time compared to the conventional construction method, where the site is first prepared, and the structure is then constructed at the exact location. The built prefabricated steel structure is shipped to the job site where it is installed. The most common prefabricated steel products are doors, stairs, wall panels, floor panels, window walls, roof trusses, room-sized components, and even entire buildings such as office spaces, medical camps, and prison cells.

Owing to the high real-estate costs post-COVID-19 pandemic, the average sales price of conventional construction spiked and compelled developers and buyers to look for low-cost alternatives. Off-site construction is a way out that delivers high-quality and affordable housing in minimal time. Purchasing a fabricated or modular house saves up to 10–20% of the cost compared to conventional homes, owing to assembly line efficiency and low labor requirements. In extreme situations, the owner can disassemble the house and shift to another location.

The surging demand for prefabricated structures has compelled market players to expand their operations and capabilities. In April 2023, the Economic Development Corporation in Mission City, Texas (Mission EDC), disclosed the expansion plans for RODCO Steel Distributors, a prominent prefabricated steel building manufacturer. With a substantial investment of USD 9.5 million, the project aims to construct 100,000 square feet of additional industrial space, fostering job creation and contributing to the economic advancement of the region.

Request a free sample copy or view report summary:

U.S. Prefabricated Steel Market Report

U.S. Prefabricated Steel Market Report Highlights

- The market has experienced robust growth because of its speed, cost-efficiency, and sustainable features. Key factors driving this growth include the need for rapid infrastructure development and the advantages of steel in modular construction

- Based on application, the residential segment is anticipated to register a CAGR of 6.0% over the forecast period, owing to increasing penetration of prefabrication in multi-family housing projects

- Under the non-residential segment, healthcare held a revenue share of over 19.0% in 2022. Factors propelling the need for prefabricated buildings in healthcare include minimal budgets of hospitals looking for low-cost construction, growing telehealth demand requiring tech-first spaces, and the rising need for cleaner and contamination-free environments

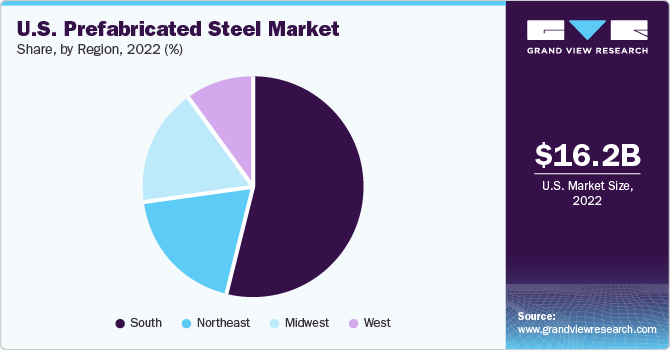

- West U.S. held a revenue share of over 10.0% in 2022. The growing urbanization rate fosters the region’s demand for prefabricated steel structures. Arizona, Colorado, Nevada, California, and Washington are among the top 15 urbanized U.S. states as of 2022

- The surge in demand has intensified competition among major players in the industry, leading to innovations in design, technology, and service delivery. Competitive rivalry centers on capturing market share and offering superior solutions to meet evolving customer requirements, further propelling the market’s growth

U.S. Prefabricated Steel Market Segmentation

Grand View Research has segmented the U.S. prefabricated steel market based on application, and region:

U.S. Prefabricated Steel Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018–2030)

- Residential

- Non-residential

- Prisons & Detention Centers

- Healthcare Facilities

- Industrial Buildings

- Others

U.S. Prefabricated Steel Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018–2030)

- U.S.

- Northeast

- Midwest

- West

- South

List of Key Players in the U.S. Prefabricated Steel Market

- BMarko Structures Inc.

- Carl A. Nix Welding Service, Inc.

- Cornerstone Inc.

- Eagle Companies

- MODLOGIQ, Inc

- Modular Genius

- Nashua Builders

- Panel Built, Inc.

- SteelCell of North America, Inc.

- Sunbelt Modular, Inc.

- Sweeper Metal Fabricators Corp.

- U.S. Engineering Company Holding

- Vanguard Modular Building Systems

- Wilmot Modular

- Z Modular