September 2024 | Report Format: Electronic (PDF)

U.S. Heating Equipment Market Growth & Trends

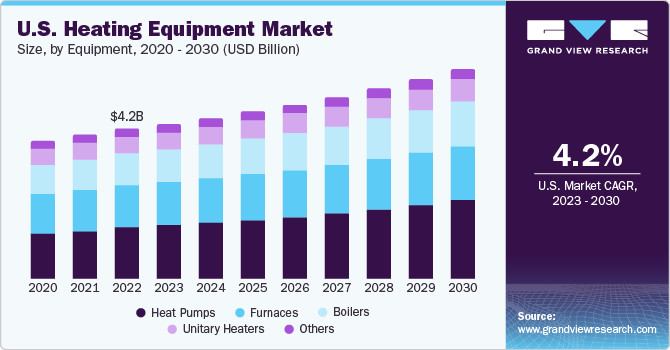

The U.S. heating equipment market size is expected to reach USD 5.88 billion by 2030, registering a CAGR of 4.2% from 2023 to 2030, according to a new report by Grand View Research, Inc. Growing demand for energy-efficient heating equipment and favorable government initiatives is projected to augment market demand over the coming years. The heat pumps segment occupied the largest share in 2015 on account of its increasing preference in the industrial and commercial sectors. Heat pumps are very efficient in converting energy to heat at low operational costs.

Boilers and furnaces are extensively used heating systems in the residential sector. Electric furnaces are gaining wide preference as they require less maintenance, are one of the least expensive, and are free from harmful emissions. Boilers are further categorized on the basis of product, size, and technology.

The growth of the housing and construction sector for the single and multi-unit dwelling is expected to boost the demand for over the coming years. The sluggish oil & gas prices have further facilitated the wide application of heating equipment in the U.S. industrial and residential segment

Favorable federal and state policies in the U.S. are projected to further drive the demand. Installing an energy-efficient heating system qualifies residential buyers to claim 10% of the cost of labor, professional preparation, and cost of installation. Rising awareness of greenhouse emissions has led to the replacement of old heating equipment by new energy-efficient solutions thereby facilitating the U.S. heating equipment market growth.

Request a free sample copy or view report summary:

U.S. Heating Equipment Market Report

U.S. Heating Equipment Market Report Highlights

- Heat pumps segment accounted for 34.1% of the market revenue in 2022

- Heat pumps are used for temperatures with moderate heating and cooling requirements, thereby finds increased application in the residential segment

- Easy credit accessibility or financial support is anticipated to spur consumer spending on renovation and remodeling activities, which, in turn, will benefit the heating equipment market

- Steam boilers accounted for the largest market share in 2022

- ECO-Labelling of heating equipment is used to encourage and guide customers in their choice of products

- The emergence of climate and energy as a political priority has spurred an increased interest in heating and energy efficiency gains to be realized within buildings.

U.S. Heating Equipment Market Segmentation

Grand View Research has segmented the U.S. heating equipment market based on equipment, application, and region:

U.S. Heating Equipment Product Outlook (Revenue, USD Million, 2018–2030)

- Heat pumps

- Furnaces

- Boilers

- The U.S. boilers market product outlook

- Water boilers

- Steam boilers

- The U.S. boilers market size outlook

- <10 MMBtu/hr

- 10–50 MMBtu/hr

- 50–100 MMBtu/hr

- 100–250 MMBtu/hr

- >250 MMBtu/hr

- The U.S. boilers market technology outlook

- Water-tube boilers

- Fire-tube boilers

- Unitary heaters

- Others

U.S. Heating Equipment Application Outlook (Revenue, USD Million, 2018–2030)

- Residential

- Commercial

- Industrial

List Of Key Players U.S. Heating Equipment Market

- Ingersoll Rand

- Lennox International Inc.

- Burnham Holdings, Inc.,

- Johnson Controls

- Robert Bosch GmbH

- Honeywell International Inc

- Daikin Comfort Technologies North America, Inc.

- Emerson Electric Co.

- Rheem Manufacturing Company

- American Heating