September 2024 | Report Format: Electronic (PDF)

U.S. E-cigarette & Vape Market Growth & Trends

The U.S. e-cigarette & vape market size is expected to reach USD 69.53 billion by 2030, expanding at a CAGR of 29.8% from 2024 to 2030, according to a new report by Grand View Research, Inc. Various factors, such as the rapid growth of vape shops in the U.S. and the increasing popularity of e-cigarettes among the youth population, is expected to drive the market growth over the forecast period. E-cigarettes and vape mods are being increasingly used by users as a substitute for smoking traditional cigarettes.

Due to the increasing health concern over the usage of conventional tobacco cigarettes, the market is expected to witness significant growth. The U.S. owns the widest e-cigarette and vape mod distribution network for sale. However, the new taxation rules among the states of the country are expected to act as potential threats to market growth during the forecast period.

Users across the globe are focusing on using personalized vaporizers. These vaporizers allow a high degree of customization by which the user can keep track of the battery strength, amount of vapor, and amount of nicotine consumed. The rapid surge in the number of available flavors that can be used to fill the cartridge is expected to drive the market growth over the forecast period.

In the U.S., the increasing usage of flavored electronic cigarettes among high school students is expected to propel the market growth. The cases of tobacco-related cancer in the U.S. are increasing. This, as a result, users are looking for alternatives to tobacco smoking, thereby driving the market growth.

Request a free sample copy or view report summary:

U.S. E-cigarette & Vape Market Report

U.S. E-cigarette & Vape Market Report Highlights

- The modular devices segment is expected to emerge as the fastest-growing segment over the forecast period as these devices are known for their high vapor production. Moreover, these devices can be constantly refilled by users

- An increasing shift in consumer preferences from conventional smoking to e-cigarette and e-liquids is expected to drive the e-liquid segment growth over the forecast period. To make sure that e-liquids are harmless for consumption in e-cigarettes, e-liquid manufacturers are collaborating with research scientists to improve on the safety standards

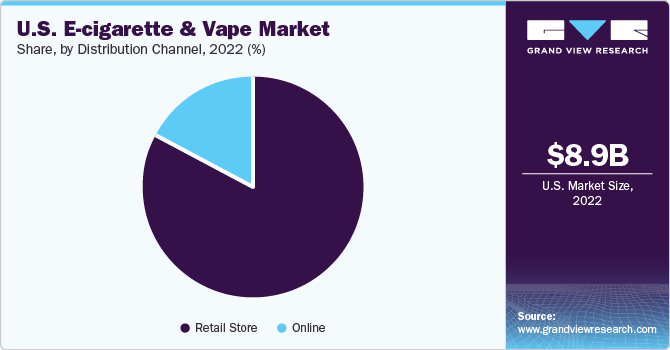

- The online distribution channel segment is expected to emerge as the fastest-growing segment over the forecast period. Numerous players across the globe are planning and executing online advertising campaigns, which catch the attention of youth since e-cigarette and vape are growing as a trend in the extensive social media influencer community

U.S. E-cigarette & Vape Market Segmentation

Grand View Research has segmented the U.S. e-cigarette & vape market based on product and distribution channels:

U.S. E-cigarette & Vape Product Outlook (Revenue, USD Million, 2018–2030)

- Disposable

- Rechargeable

- Modular Devices

U.S. E-cigarette & Vape Distribution Channel Outlook (Revenue, USD Million, 2018–2030)

- Online

- Retail Store

- Convenience Stores

- Drug Stores

- News Stands

- Tobacconist

- Specialty E-cigarette Stores

List of Key Players of U.S. E-cigarette & Vape Market

- Reynolds American Inc.

- Imperial Brands

- Altria Group, Inc.

- Japan Tobacco Inc.

- Philip Morris International

- International Vapor Group

- British American Tobacco

- NicQuid

- Shenzhen IVPS Technology Co., Ltd.

- Shenzhen KangerTech Technology Co., Ltd.