September 2024 | Report Format: Electronic (PDF)

Sepsis Diagnostics Market Growth & Trends

The global sepsis diagnostics market size is expected to reach USD 1.82 billion by 2030, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 8.0% from 2024 to 2030. The high prevalence of sepsis, the introduction of technologically advanced diagnostic systems, and increasing government initiatives are expected to propel market growth over the forecast period. Sepsis is a bloodstream disease that occurs as a result of a response to pathogenic microorganisms present in the blood. Patients suffering from this disease experience severe inflammation, which leads to prolonged hospitalization.

According to the WHO, around 30 million people are estimated to be affected by this disease every year. The NCBI stated that the largest number of this condition have been observed in the youngest and oldest age groups. Thus, there is a rising need for the early diagnosis of this disease. The WHO reported that every year, 1.2 million children and 3 million newborns are affected by this disease across the world. This has further boosted the demand for its diagnostic tools for quick results and improved patient outcomes. Increasing regulatory approval and the introduction of technologically advanced diagnostic solutions for sepsis are expected to facilitate market growth over the forecast period.

In May 2018, T2 Biosystems, Inc., a U.S.-based emerging diagnostic solutions company, received the U.S. FDA approval for its T2Bacteria Panel, intended for the detection of specific sepsis-causing bacterial pathogens in human whole blood specimens. The COVID-19 pandemic affected the growth of diagnostics products for sepsis in a moderately positive way. The worldwide spread of Coronavirus and the arising instances of sepsis among COVID-19 patients are probably going to expand the interest for fast detection, speeding up the use of instruments, reagents, and assay kits for recognition of sepsis. Pandemic-induced lockdown and other restrictions made individuals delay going through wellbeing checkups, influencing the number of tests performed and reagent deals.

The pandemic has featured the risk upon elders, who are more defenseless to complications, including intense respiratory distress condition, typically because of pneumonia, which builds the risk of creating sepsis. This has created a need for the early detection of sepsis among patients with COVID-19. Symptoms of sepsis, such as multiorgan injuries, develop in around 2.0 to 5.0% of COVID-19 cases 8 to 10 days post-hospitalization, based on the estimates of the Global Sepsis Alliance. To manage this situation, the Biomedical Advanced Research and Development Authority, in May 2020, extended its partnership with Beckman Coulter for the development of a digital algorithm to detect sepsis in patients with COVID-19.

Request a free sample copy or view the report summary:

Sepsis Diagnostics Market Report

Sepsis Diagnostics Market Report Highlights

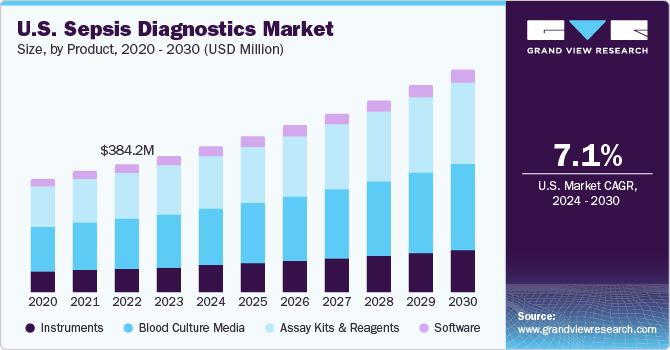

- Based on product type, blood culture media dominated the market in 2023 with a revenue share of more than 38.9%, as blood culture is considered the most cost-effective and convenient testing mode.

- The microbiology technology segment dominated the market in 2023 and held the largest share of more than 48.9% of the overall revenue. Microbial culture is the primary and gold standard method for detecting infectious disease-causing organisms in laboratory settings.

- Bacterial segment held the largest revenue share of 86.0% of the market in 2023. It is anticipated to lead over the forecast period due to the rise in cases of bacterial sepsis, higher occurrence of hospital-transmitted infections, and rising number of surgical procedures conducted.

- The conventional diagnostics segment held the largest revenue share of 57.6% of the market in 2023.

- The laboratory testing type segment dominated the market in 2023 with a share of 82.6%. Advancements in laboratory testing have made it easier and faster to detect sepsis, leading to better outcomes for patients.

- North America dominated the market in 2023 and held the largest revenue share of more than 44.1%. High incidence of sepsis and infectious diseases is expected to fuel demand for novel diagnostic solutions.

Sepsis Diagnostics Market Segmentation

Grand View Research has segmented the global sepsis diagnostics market report based on product, method, end-user, technology, pathogen, testing type, and region:

Sepsis Diagnostics Product Outlook (Revenue, USD Million, 2018–2030)

- Instruments

- Blood Culture Media

- Assay Kits and Reagents

- Software

Sepsis Diagnostics Technology Outlook (Revenue, USD Million, 2018–2030)

- Microbiology

- Molecular Diagnostics

- Polymerase Chain Reaction (PCR)

- DNA Microarrays

- Syndromic Panel testing

- Others

- Immunoassays

- Flow Cytometry

- Others

Sepsis Diagnostics Pathogen Outlook (Revenue, USD Million, 2018–2030)

- Bacterial Sepsis

- Gram-positive Bacteria

- Gram-negative Bacteria

- Fungal Sepsis

- Viral Sepsis

- Others

Sepsis Diagnostics Testing Type Outlook (Revenue, USD Million, 2018–2030)

- Laboratory Testing

- PoC Testing

Sepsis Diagnostics Method Outlook (Revenue, USD Million, 2018–2030)

- Automated Diagnostics

- Conventional Diagnostics

Sepsis Diagnostics End-user Outlook (Revenue, USD Million, 2018–2030)

- Hospitals & Clinics

- Pathology & Reference Laboratories

- Research Institutes and Others

Sepsis Diagnostics Regional Outlook (Revenue, USD Million, 2018–2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- Spain

- France

- Italy

- Russia

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Singapore

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

- Kuwait

List of Key Players of Sepsis Diagnostics Market

- BD, Becton, Dickinson & Company

- bioMérieux SA

- Thermo Fisher Scientific, Inc.

- Danaher Corporation (Beckman Coulter, Inc.)

- F. Hoffmann-La Roche AG

- Cepheid

- Luminex Corp.

- Koninklijke Philips N.V.

- Bruker

- Immunexpress, Inc.