September 2024 | Report Format: Electronic (PDF)

Automotive Electronics Market Growth & Trends

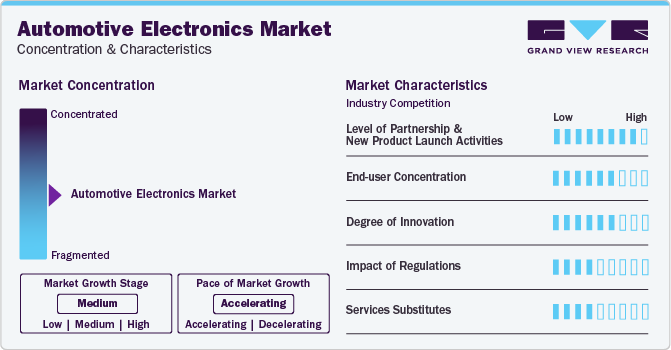

The global automotive electronics market size is expected to reach USD 468.17 billion by 2030, expanding at a CAGR of 8.8% during the forecast period, according to a new report by Grand View Research, Inc. Increased safety and security concerns would fuel demand for car electronics as governments around the world try to reduce the number of road fatalities. The growing need for driverless automobiles, electric vehicles, and cutting-edge vehicle technologies is also anticipated to drive the automotive electronics industry. Some of the notable technologically cutting-edge features that are anticipated to fuel market expansion throughout the forecast period include alcohol ignition interlocks, emergency call systems, and accident data recorder systems.

Advanced safety systems with functions like automated emergency braking and blind-spot recognition are now more widely used since they are more affordable. The use of automotive ECUs and sensors used in these systems is then anticipated to increase, driving the growth of the automotive electronics industry throughout the course of the forecast period. Additionally, these characteristics follow government laws and policies and are thought to open the door for the adoption of autonomous vehicles. The electronic operations in these vehicles are controlled by ECUs and sensors, which raises the need for these parts.

The automotive electronics industry is also affected by the recent semiconductor chip shortages globally. The automakers have been severely impacted by the shortage of semiconductor chips, which has forced them to temporarily cease production in their facilities as a result of the pandemic supply-chain gyrations and escalating demand. In April 2021, General Motors and Ford announced plans to temporarily shut down their factories due to a shortage of semiconductor chips. The chaotic ordering from the automotive OEMs makes it harder for chipmakers to understand where they need to allocate supply to meet real and short-term needs.

The Asia Pacific regional market captured around 41.3% of the overall automotive electronics demand in 2022 and is estimated to register the highest CAGR of 9.0% over the forecast period. The demand in Asia Pacific is largely fulfilled by China, India, and Japan. China is the world’s largest manufacturing hub and one of the fastest-growing economies. The Chinese automotive manufacturers are leveraging favorable market conditions to take the lead and dominate the market. Moreover, the Make in India campaign is expected to draw investments in the automotive sector, thus boosting the demand for automotive electronics.

Request a free sample copy or view report summary:

Automotive Electronics Market Report

Automotive Electronics Market Report Highlights

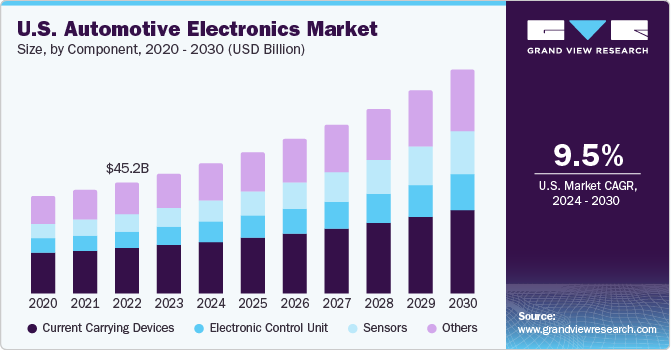

- In terms of component, the sensors segment is estimated to expand at the highest CAGR of around 9.9% over the forecast period. This can be attributed to favorable government initiatives for passenger safety and security in various regions

- In terms of application, the safety system segment emerged as the largest segment in 2023. Increasing customer awareness about technological changes related to safety equipment in vehicles is expected to act as a potential driver for the growth of the safety systems segment

- In terms of sales channel, OEM emerged as the largest segment in 2023 owing to the increased durability and shelf-life of electronic components

- The Asia Pacific regional market held the largest revenue share in 2023. This can be attributed to the increasing production of vehicles in India, China, and Japan.

Automotive Electronics Market Segmentation

Grand View Research has segmented the global automotive electronics market based on component, application, vehicle type, propulsion, sales channel, and region:

Automotive Electronics Component Outlook (Revenue, USD Million, 2018–2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

Automotive Electronics Application Outlook (Revenue, USD Million, 2018–2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

Automotive Electronics Vehicle Type Outlook (Revenue, USD Million, 2018–2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Automotive Electronics Propulsion Outlook (Revenue, USD Million, 2018–2030)

- ICE

- Electric

Automotive Electronics Sales Channel Outlook (Revenue, USD Million, 2018–2030)

- OEM

- Aftermarket

Automotive Electronics Regional Outlook (Revenue, USD Million, 2018–2030)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

List Of Key Players in the Automotive Electronics Market

- Continental AG

- DENSO Corporation

- Hella GmbH & Co. Kgaa

- Hitachi Automotive Systems, Ltd.

- Infineon Technologies AG

- Robert Bosch GmbH

- Valeo Inc.

- Visteon Corporation

- Xilinx, Inc.

- ZF Friedrichshafen AG