August 2024 | Report Format: Electronic (PDF)

Robot Operating System Market Growth & Trends

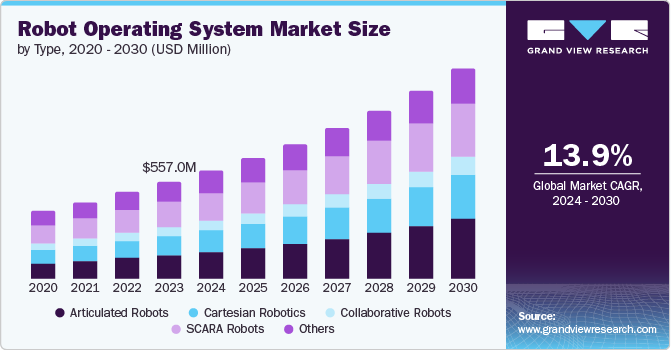

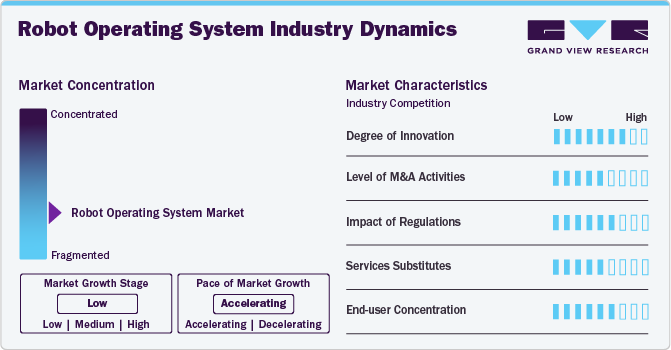

The global robot operating system market size is expected to reach USD 1,214.9 million by 2030, according to a new report by Grand View Research, Inc. The market is anticipated to grow at a CAGR of 13.9% from 2024 to 2030. The robot operating system (ROS) is a comprehensive collection of tools and frameworks designed for developing and controlling robotic systems. ROS is shaping the future of robots in business, enterprise, and development. Traditionally, designing the embedded software in robots was the domain of robotic researchers and designers. Today, Ubuntu serves as the primary base for ROS due to its adaptability and user-friendliness. Being an open-source platform, ROS allows researchers and programmers to write and reuse code for various robotics applications. A global community of engineers and programmers, known as the “robot operating system,” is dedicated to advancing and enhancing ROS’s usability, aiming to make robots accessible worldwide.

Industrial automation is a key driver of economic transformation, reshaping industries and economies globally. Continuous advancements in digital technologies and the adoption of automation solutions have led to significant increases in productivity, efficiency, and competitiveness across various sectors. Automated systems offer superior speed, accuracy, and consistency, outperforming manual labor, especially in industries like manufacturing and logistics where routine processes are common. These advantages are expected to accelerate the adoption of industrial automation solutions, subsequently driving the growth of the ROS market.

While adopting ROS automation in a manufacturing environment might seem daunting, these solutions are now more feasible than ever and can significantly enhance a firm’s competitive advantage. Since the 1990s, there has been a substantial increase in robot production, leading to reduced costs for such machinery. Consequently, the growing adoption of automation in the manufacturing sector has driven the use of ROS, presenting a significant opportunity for the growth of the market for robot operating system.

Moreover, the Industrial Internet of Things (IIoT) and e-commerce platforms offer SMEs new capabilities to utilize ROS platforms for delivering customized services and products. This is expected to facilitate their international expansion and growth into micro-multinational corporations, creating new jobs and income, fostering innovation, and enhancing productivity. Consequently, this will drive the adoption of ROS across various industry verticals.

Request a free sample copy or view report summary:

Robot Operating System Market Report

Robot Operating System Market Report Highlights

- Based on offering, the SCARA robots segment led the market and accounted for 26.1% of the global revenue in 2023. This growth is driven by several factors, including increasing adoption across various industries such as automotive, electronics, pharmaceuticals, and consumer goods.

- The articulated robots segment is estimated to grow significantly over the forecast period. The integration of advanced technologies such as artificial intelligence and machine learning is enhancing the capabilities of articulated robots, allowing for more adaptive and efficient operations.

- Based on enterprise size, the mapping and navigation segment dominated the market in 2023. The mapping and navigation capabilities within robot operating systems are experiencing significant growth, driven by a confluence of technological advancements and increasing demand across various industries.

- On the other hand, the home automation and security segment are projected to grow significantly over the forecast period. The growth is driven by a convergence of technological advancements and increasing consumer demand for smart home solutions.

- Based on deployment, the metal and machinery segment accounted for the largest market revenue share in 2023. is experiencing significant growth in the adoption of Robot Operating System (ROS) applications, driven by the increasing demand for industrial automation and the need for more flexible, efficient manufacturing processes.

- The automotive segment, on the other hand, is predicted to foresee significant growth in the forecast period. This growth is driven by the increasing demand for automation and the need for more precise, efficient manufacturing processes.

- Based on end use, the BFSI segment accounted for a leading revenue share of the market in 2023. In recent years, artificial intelligence (AI) and machine learning technologies have been increasingly adopted in the banking, financial services, and insurance (BFSI) industry to boost operational efficiency and enhance the consumer experience.

Robot Operating System Market Segmentation

Grand View Research has segmented the global Robot Operating System market based on robot type, application, end use and region:

Robot Operating System (ROS) Robot Type Outlook (Revenue, USD Million, 2017–2030)

- Articulated Robots

- Cartesian Robotics

- Collaborative Robots

- SCARA Robots

- Others

Robot Operating System (ROS) Application Outlook (Revenue, USD Million, 2017–2030)

- Pick and Place

- Plastic Injection and Blow Molding

- Testing and Quality Inspection

- Metal Sampling and Press Trending

- End of Line Packaging

- Mapping and Navigation

- Inventory Management

- Home Automation and Security

- Personal Assistance

Robot Operating System (ROS) End Use Outlook (Revenue, USD Million, 2017–2030)

- Automotive

- Electrical and Electronics

- Metal and Machinery

- Plastics

- Rubber and Chemicals

- Food and Beverages

- Healthcare

- Others

Robot Operating System (ROS) Regional Outlook (Revenue, USD Million, 2017–2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa (MEA)

- Kingdom of Saudi Arabia

- UAE

- South Africa

List of Key Players operating in Robot Operating System Market

- Universal Robotics

- ABB Ltd.

- FANUC

- KUKA AG

- Yaskawa Electric Corporation

- Denso

- Microsoft

- Omron Corporation

- iRobot Corporation

- Clearpath Robots