Surge Protection Devices Market Growth & Trends

The global surge protection devices market size is expected to reach USD 4.88 billion by 2030, growing at a CAGR of 6.8% from 2023 to 2030, according to a new report by Grand View Research, Inc. The growth of the market can be attributed to the growing need to protect electronic devices from any potential surges. The alternative energy programs being pursued aggressively all over the world and the growing instances of lightning strikes stemming from the increase in global warming are some of the other factors that are expected to drive the demand for surge protection devices (SPD) over the forecast period.

A surge occurs due to voltage imbalances, interferences in transformers, radio interferences, or differences in potential. Electronic devices can be highly vulnerable to transient voltages. At this juncture, surge protection devices are widely used in electrical installation systems to protect electronic devices. Surge protection devices can be considered a cost-effective solution to improve the system and data reliability while preventing any undesirable downtime.

The players in the market are focused on the new product development of surge protection devices. For instance, in March 2023, Transtector Systems, a power and signal integrity solution provider launched a new outdoor, 10 GbE, PoE++ data surge protector. It is designed to be used with 10 Gigabit Ethernet and PoE++ networks, WISP/ISP, telecom base stations, point-to-point links, IT and data centers, sense loops, control lines, and other applications. It provides protection against electrical transient surges produced by both internal switching events and lightning strikes.

The outbreak of the COVID-19 pandemic took a severe toll on the surge protection devices market. The fluctuations in raw material prices owing to supply chain disruptions stemming from the restrictions on the movement of people and goods and the temporary closures of manufacturing plants as part of the efforts to arrest the spread of coronavirus in the wake of the outbreak of the pandemic restrained the growth of the market. However, the growing adoption of protection systems for high-technology equipment in various emerging economies is expected to create new growth opportunities for the market over the forecast period.

Request a free sample copy or view report summary:

Surge Protection Devices Market Report

Surge Protection Devices Market Report Highlights

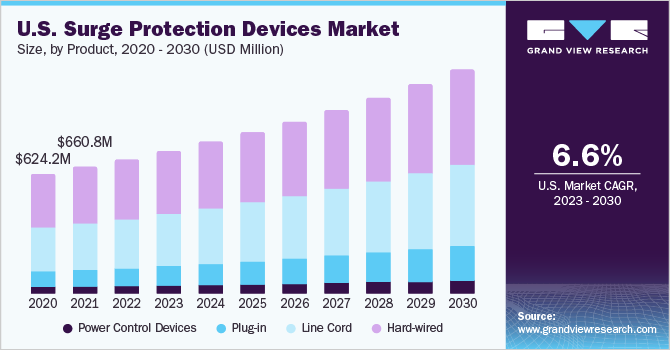

- The hard-wired segment dominated the market in 2022. The growing adoption of hard-wired SPDs in commercial, residential, and industrial applications to detect and limit power surges and transient voltages that can potentially damage any equipment connected to signal and power lines is expected to drive the growth of the segment over the forecast period.

- The Type 1 segment is expected to grow at the highest CAGR over the forecast period. Type 1 SPDs are particularly used to protect electronic equipment from lightning surges. Type 1 SPDs are considered the first line of defense for any home or office electrical infrastructure.

- The 50.1–100 kA segment is anticipated to witness significant growth over the forecast period in line with the rapid residential and commercial infrastructure development across the globe.

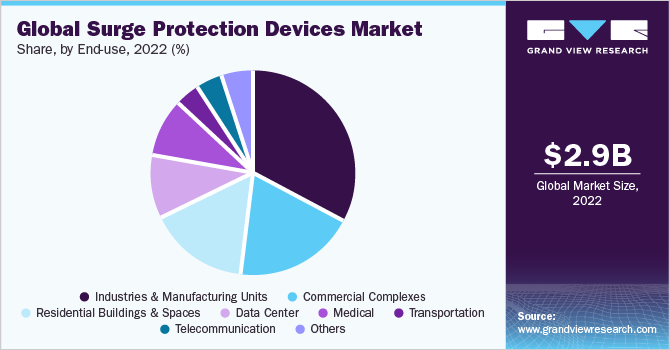

- Industries & manufacturing units are the major end users of SPDs. SPDs provide industrial and manufacturing machinery with safer interlock circuits that can effectively protect electrical and electronic equipment from any overvoltage stemming from switching or lightning surges.

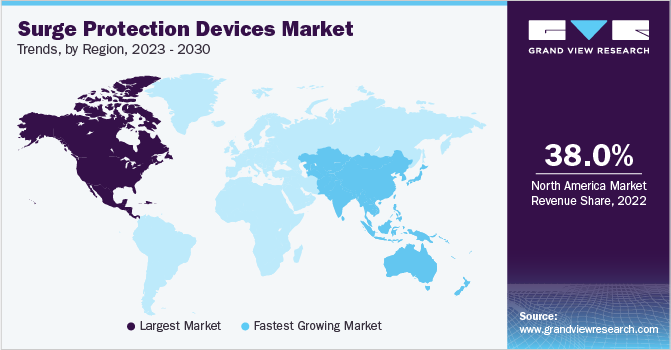

- Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period owing to the aggressive investments being made to cater to the rising demand for energy in line with the growing population. The increasing residential and commercial construction activities in the region are also expected to contribute to the growth of the regional market over the forecast period.

Key Companies & Market Share Insights

The market can be described as highly competitive owing to the presence of several prominent players. Key strategies adopted by the market players include new product development, capacity expansion, merger & acquisition, strategic collaborations, partnerships, and agreements; and investment in research & development activities. Companies, such as General Electric Company, are particularly focusing on providing power strips and wall tap surge protectors. Companies are particularly providing 6-outlet, 2-outlet, 4-outlet, and 8-outlet power strip surge protectors.

Having realized that product quality is the key aspect of the market, key players are focusing on enhancing their product portfolios. Key players are primarily focusing on developing sophisticated and innovative products based on extensive research and development. For instance, in June 2023, Littelfuse, Inc., an industrial technology manufacturing company, launched the National Electrical Manufacturers Association (NEMA) style Surge Protective Device (SPDN) series to protect equipment from transient overvoltage situations that last for micro-seconds and help reduce downtime and costly damage. Some of the prominent players in the global surge protection devices market are:

- ABB Ltd.

- General Electric Company

- Schneider Electric

- Eaton Corporation plc

- Legrand

- Emerson Electric Co.

- Siemens

- CG Power and Industrial Solutions Limited

- Littelfuse, Inc.

- Bourns, Inc.