Chemical Distribution Market Growth & Trends

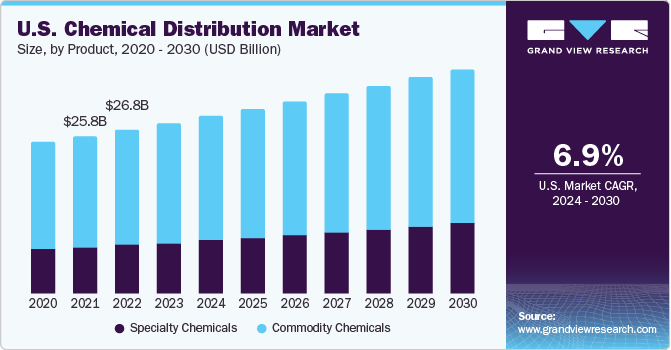

The global chemical distribution market size is expected to reach USD 403.2 billion by 2030, registering a CAGR of 6.3% from 2024 to 2030, according to a new report by Grand View Research, Inc. The growth is majorly driven by rising demand for a variety of specialty and commodity chemicals from numerous end-use industries around the world.

The consumption of specialty goods like CASE (coatings, adhesives, sealants, and elastomers), polymers and resins, agrochemicals, and building chemicals, which are currently used in small amounts, is expected to increase significantly in the future years. Since the regional governments monitor these substances closely, only a few producers create them.

Most end-use sectors, including those in construction, automotive, infrastructure, electronics, and medicines, utilize specialty and commodity chemicals. Due to accelerating industrialization, particularly in China, the demand for chemicals has increased quickly throughout the Asia Pacific region. Significant demand for electronic-grade raw materials has resulted from the country’s rising electronics output and customers’ increasing purchasing power, which is helping the chemicals distribution industry thrive.

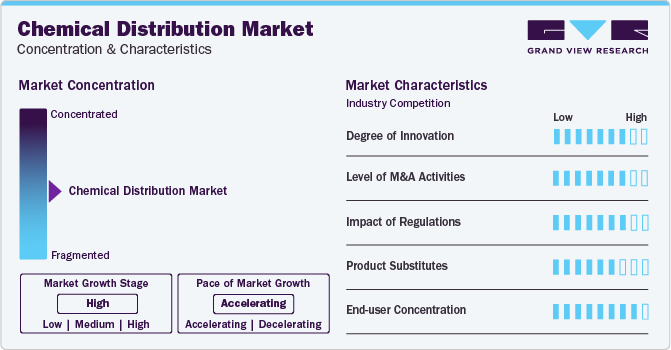

On the contrary, in order to attain structurally efficient cost, market share, and competitive advantage, small and large manufacturing enterprises are expected to form strategic alliances with foreign players. This would enable them to better serve their worldwide customers. Furthermore, the acquisition has been a crucial strategy for chemical firms looking to expand their customer base and fortify their supply chain.

Another issue that presents a barrier in the supply chain for chemicals is the dependence of manufacturers on suppliers for the safe delivery of non-bulk and loose chemical substances and managing varied logistics requirements, including repackaging and custom blending. The National Association of Corporate Directors (NACD) and other regulatory bodies supervise the implementation of safety standards for product transportation and distribution across North America, while REACH oversees safety requirements in Europe.

Request a free sample copy or view report summary:

Chemical Distribution Market Report

Chemical Distribution Market Report Highlights

- Specialty chemicals product type witnessed the fastest growth rate of more than 7%, owing to the rising product application in specific end-use industries like pharmaceuticals, polymers, mining, food & feed, and paints & coatings

- Pharmaceuticals end-use industry witnessed a notable growth rate of 7.4% on the account of increasing investments in developing economies and the growing importance of human health and its associated issues, especially after the COVID-19 outbreak

- Synthetic rubber witnessed a significant growth rate of nearly 5.5%, due to its vast applicability in the production of conveyor belts, industrial goods, tires, clutches, and engine bearings among others

- Downstream chemicals witnessed the highest CAGR of 6.2%, among other end-uses, on the account of its usage in the petrochemicals industry around the world

- Geographically, Asia Pacific dominated the market in 2023 owing to the booming end-use industries such as mining and automotive in the region

List of Key Players in the Chemical Distribution Market

- Univar Solutions Inc.

- Helm AG

- Brenntag AG

- Ter Group

- Barentz

- Azelis

- Safic Alan

- ICC Industries, Inc.

- Jebsen & Jessen Pte. Ltd.

- Quimidroga

- Solvadis Deutschland GmbH

- Ashland

- Caldic B.V.

- Wilbur Ellis Holdings, Inc.

- Omya AG

- IMCD

- Biesterfeld AG

- Stockmeier Group

- REDA Chemicals

- Manuchar