Persulfates Market Growth & Trends

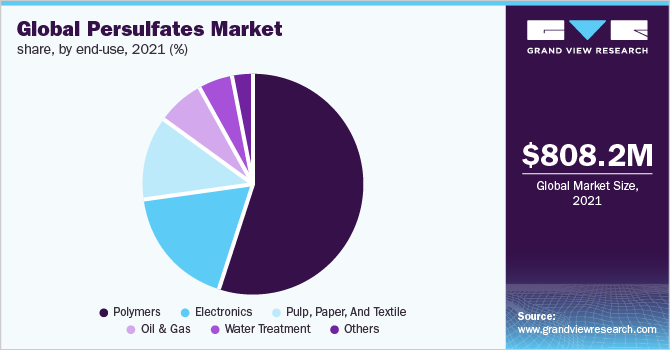

The global persulfates market size is estimated to reach USD 1.10 billion by 2030, according to a new report by Grand View Research, Inc., expanding at a CAGR of 3.5% from 2022 to 2030. The growth can be attributed to the wide usage of persulfates for initiating emulsion polymerization reactions. Salts of sulfate are majorly used as radical initiators in the polymerization of certain alkenes. Persulfates are strong oxidants having excellent shelf life when stored properly. Moreover, they are economical to use, thus making them suitable for a variety of applications.

Ammonium persulfate (APS) is used to treat metal surfaces, manufacture semiconductors, and etch copper on printed circuit boards. It is also used in the production of disinfectants. APS and hydrogen peroxide are used as oxidants in several industrial processes and are crucial constituents of standard hair bleaching products. Ammonium, sodium, and potassium persulfate are inorganic salts used as oxidizing agents in hair coloring preparations and hair bleaches. Persulfates are used in hair lighteners at a concentration of up to 60%.

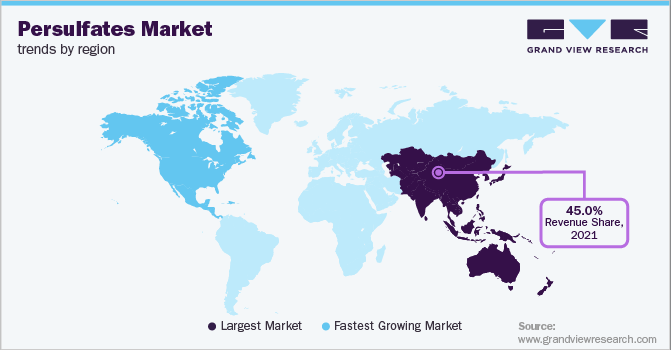

Asia Pacific is expected to expand at the highest CAGR over the forecast period owing to a rapidly increasing manufacturing base and the growing plastics and rubber industries in the region. Additionally, rising concerns regarding water pollution in Asia Pacific are projected to fuel the demand for persulfates in the coming years.

Request a free sample copy or view report summary:

Persulfates Market Report

Report Attribute Details

Market size value in 2022 — USD 831.17 million

Revenue forecast in 2030 — USD 1.10 billion

Growth Rate — CAGR of 3.5% from 2022 to 2030

Base year for estimation — 2021

Historical data — 2018–2020

Forecast period — 2022–2030

Persulfates Market Report Highlights

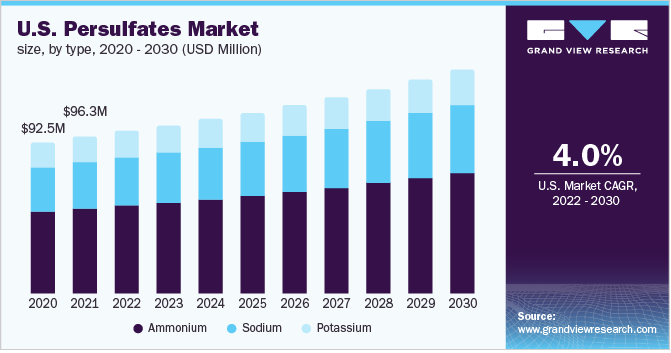

- In 2021, ammonium persulfate emerged as the dominant type segment with a revenue share of over 50.0%. This is attributed to its application as an etchant, a bleaching and cleaning agent, and a strong oxidizing agent

- The polymers end-use segment emerged as the dominant end-use segment with a revenue share of over 50.0% in 2021 owing to the high demand in the manufacturing of synthetic rubber for truck and automobile tires

- The electronics end-use segment is anticipated to expand at a significant CAGR of 4.0% in terms of revenue from 2022 to 2030 owing to the rapid growth of the consumer electronics sector across the globe

- Asia Pacific is projected to expand at the highest revenue-based CAGR over the predicted period owing to large rubber production in various countries including Vietnam, Malaysia, and Thailand