Pharmaceutical Filtration Market Growth & Trends

The global pharmaceutical filtration market size is estimated to reach USD 21.96 billion by 2030, registering a CAGR of 8.03% from 2023 to 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 8.03% from 2023 to 2030.The growing biopharmaceutical industry provides the necessary impetus for market expansion. Additionally, the rampant growth and approvals by regulatory bodies in the field of biologics and biosimilar medicines have extrapolated the need for filtration at various stages of production. For example, nearly ten large molecule drugs or biologics were approved by the U.S. FDA in 2021, which increased by 30% in the year 2022 as thirteen biologics were approved. Thereby, the increasing approvals will propel the market’s growth.

Various players involved in biopharmaceutical manufacturing are entering into collaborations or regional regulatory bodies are allowing for offshore manufacturing of large molecule drugs which provides a strong impetus to the market growth. For instance, in August 2022, Europe Medicines Agency provided Good Manufacturing Practice (GMP) certification to a CDMO, Charles River Laboratories of the U.S.

The following certification will now allow for offshore manufacturing of allogenic cell therapy products, thereby increasing the demand for pharmaceutical filtration products. Additionally, various market players are introducing filtration technology at both upstream and downstream levels of biopharmaceutical manufacturing, hence, proportionating the demand for pharmaceutical filter products. For example, in November 2022, Alfa Laval launched a multipurpose membrane filtration system for upstream and downstream application levels for both food and pharmaceutical manufacturing.

Due to the onset of the pandemic, a surge in the development of vaccines and biologics led to a positive impact on pharmaceutical filtration products as biopharmaceutical manufacturing requiring the usage of vaccines necessitate filtration processes. Furthermore, the utilization of single-use filtration products provided immense traction to the market, as manufacturers and researchers had to avoid any chance of cross-contamination with the viral strains used.

For instance, in September 2022, Pall Corporation announced the launch of three new Allegro Connect Systems, in continuation with the single-use portfolio of filter systems. The following product will provide automation control and control the risks, adding immense value to the pharmaceutical production of therapeutic drugs and vaccines. However, the pandemic also imposed various issues in the supply chain, which in turn negatively impacted the manufacturing and commercialization process of the COVID-19 vaccines to a certain extent.

Request a free sample copy or view report summary:

Pharmaceutical Filtration Market Report

Pharmaceutical Filtration Market Report Scope

Report Attribute Details

Market size value in 2023 — USD 12.79 billion

Revenue forecast in 2030 — USD 21.96 billion

Growth rate — CAGR of 8.03% from 2023 to 2030

Base year for estimation — 2022

Historical data — 2018–2021

Forecast period — 2023–2030

Pharmaceutical Filtration Market Report Highlights

- By product, the membrane filter segment held the largest share of 26.08% in 2022. The product provides precise and uniform pore size distribution along with consistent purification capacity, ensuring pharmaceutical manufacturing standards

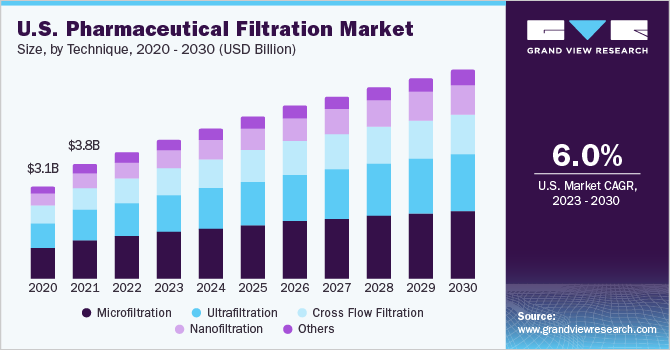

- By technique, microfiltration held the major share of 34.41% in 2022, due to the versatility to remove a wide range of impurities from biopharma products. Additionally, the technique removes impurities without impacting the biological activities of the medium

- By type, the sterile segment captured a dominant share of 55.79% in 2022 as it provides a critical manufacturing step in a plethora of pharmaceutical products. Additionally, the inclusion of automation in the process of sterile pharmaceutical filtration propels the segment

- The final product processing application segment accounted for the largest market share of 41.55% in 2022. It is primarily to ensure the safety and efficacy of the product by removing any form of impurity for patients partaking in it. Additionally, strong regulatory guidelines propel the segment hold

- By scale of operations, the manufacturing segment captured the largest share of 64.95% in 2022. The dominant share is due to an immense scale of drug manufacturing and various process control in place to ensure safety, thereby, increasing the usage of pharmaceutical filtration products at the manufacturing scale

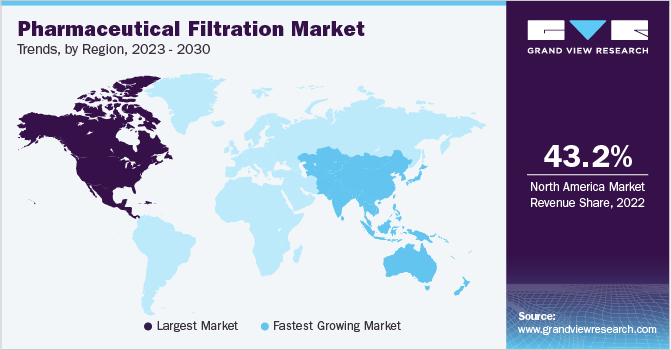

- North America holds a key position in the pharmaceutical filtration industry with a share of 43.23% in 2022. It can be attributed to the presence of various large-scale manufacturers in the region along with a strong healthcare infrastructure, supporting both the development and consumption of biopharmaceuticals

- Some key players include Meissner Filtration Products, Inc.; Merck KGaA; Sartorius AG; Danaher; 3M; Parker Hannifin Corp; Amazon Filters Ltd; Graver Technologies; Eaton; and Thermo Fisher Scientific Inc.