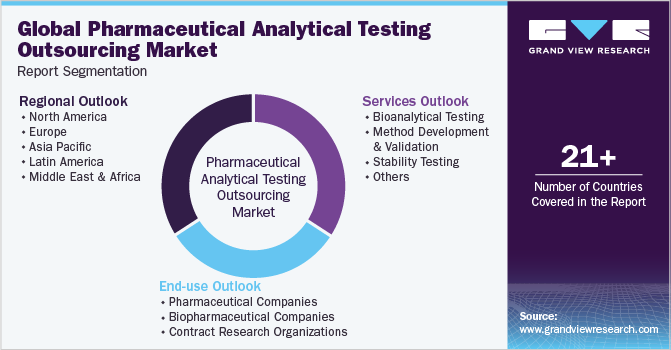

Pharmaceutical analytical testing outsourcing services market is driven by innovation in pharmaceutical industry, increasing focus on regulatory, safety & quality, end-user volume, and pricing. Various categories of tests which are outsourced include bioanalytical tests, method development & validation, and stability testing.

Bioanalytical testing involves the examination of drugs/formulation or active ingredients within a biological system such as blood, urine, serum, tissue, and others. This analysis is performed in order to characterize and quantify the drug activity and provide evidence for a therapeutic action. These tests also help in creation of the drug monograph for reference during preclinical and clinical trial testing. Broadly, the segment is further classified into clinical and non-clinical bioanalytical testing and is expected to witness lucrative growth over the forecast period.

An increasing number of clinical trial registrations and entry of new participants within the marketspace since the past ten years has contributed to the growth of the bioanalytical testing needs. These tests are solely focused on understanding the quantitative aspects of the drug discovery and development process.

Besides offering the analytical services, vendors also perform method development and validation services in order to provide pharmaceutical firms with a complete package and a hassle-free experience. The analytical tests are crucial for introduction of the product for next phase of research. Hence, their method development & validation is expected to generate higher reliability and maintain proof of the results. With rising growth of outsourcing of testing processes, an ancillary growth may be witnessed for this service too, over the forecast period.

Asia Pacific is the fastest growing market owing to many developed countries investing in Asia Pacific regions and owing to the various amendments made by the regulatory market to change the clinical trials evaluation standards according to the global platform. In October 2014, the Australian service provider Novotech started a new office in China, its ninth office in Asia. Novotech, as a company, has expanded in many developing nations owing to the request by its U.S and EU clients. In addition, in February 2014, the Charles River Laboratories declared China as a country having disproportionate growth and expressed interest in merging with potential regions in the country.

In August 2015, WuXi Pharma Tech signed a strategic partnership with Lee Pharmaceutical for laboratory testing. The CRO will provide chemistry analytical services, oncology, in-vivo and in-vitro biology, immunology, pharmacokinetic/pharmacodynamics, in-vitro ADME, clinical bioanalysis, and toxicology for its R&D programs. Moreover, the Government of India has realized the potential in the CRO sector and has laid some action plans for boosting the CRO business India.

India is one of the favored destinations for outsourcing as it has many advantages such as trained manpower, reduced cost, time difference, and IT superpower. It is estimated that by 2020, India would be among the top healthcare economies in the world. Contract research and manufacturing outsourcing are the major factors driving the Indian outsourcing market. Availability of skill and expertise, low cost service models, increasing CROs, large patient pool are the advantage India possesses which is attracting the healthcare research outsourcing market.

In-depth report on global pharmaceutical analytical testing outsourcing market by Grand View Research:

www.grandviewresearch.com/industry-analysis/pharmaceutical-analytical-testing-outsourcing-market

Pharmaceutical Analytical Testing Outsourcing Market Report Scope

Report Attribute Details

Market size value in 2023 — USD 8.2 billion

Revenue forecast in 2030 — USD 14.5 billion

Growth rate — CAGR of 8.4% from 2023 to 2030

Base year for estimation — 2022

Historical data — 2018–2021

Forecast period — 2023–2030

Pharmaceutical Analytical Testing Outsourcing Market Report Highlights

- The bioanalytical testing segment is expected to witness the fastest CAGR of 8.9% over the forecast due to the high number of clinical trial registrations and entry of new drug participants into the pharmaceutical market

- The pharmaceutical segment gained the largest revenue share of 47.3% in 2022. The growing demand among pharmaceutical companies to focus on their core competencies is one of the major reasons for the largest segment share

- North America is expected to hold the largest revenue share of 53.4% owing to the presence of a significant number of pharmaceutical companies in the region

- Asia Pacific is anticipated to be the fastest-growing regional market from 2022 to 2030 due to the low-cost service offerings by third-party service providers in the region