July 2020 | Report Format: Electronic (PDF)

The global farm tire market size is expected to reach USD 7.01 billion by 2025 at a 4.8% CAGR during the forecast period, according to a new report by Grand View Research, Inc. Rising demand for distinct agricultural vehicles for specific farming activities is expected to propel demand over the forecast period.

Population growth, coupled with limited arable land, is anticipated to result in a growing demand for high-efficiency agricultural machinery to decrease the turnaround time and increase productivity. In addition, rising awareness among farmers regarding technology upgrade of vehicles and implementation of automated equipment is expected to boost the market.

Increasing R&D activities for the development of innovative farm tire manufacturing techniques to improve product characteristics and enable its use in several agricultural vehicles is projected to have a positive impact on market growth. In addition, shortage of farm labor is projected to boost demand for agricultural equipment across several applications.

Industry participants undergo new product development to meet specific needs for advanced machinery and equipment in the agriculture sector, which is expected to drive demand. In addition, need for high performance farm tires with prolonged shelf life is expected to boost R&D activities in the agricultural sector over the forecast period.

Further key findings from the report suggest:

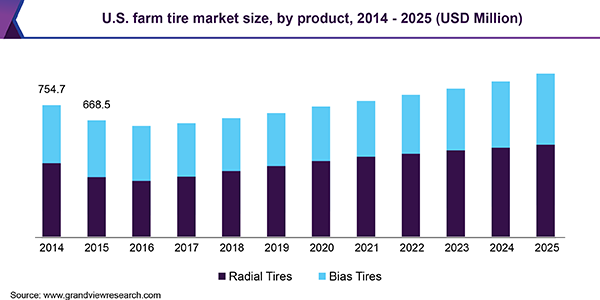

- Bias tires accounted for 75.1% of the volume in 2017 owing to low manufacturing cost associated with the product due to traditional production process

- Consumption of the product in tractors is expected to rise at a CAGR of 5.1% in terms of revenue from 2018 to 2025. This is on account of new product development and availability of multiple variants of the vehicle to suit different farming activities

- The aftermarket industry segment accounted for 59.1% of the overall volume in 2017 owing to presence of several retail platforms such as online, authorized dealers, and third-party dealers as well as growing replacement of tires by farmers

- The industry in North America is expected to register a volume-based CAGR of 3.3% during the forecast period owing to rising product demand in agricultural vehicles such as tractors and harvesters. This can be attributed to mechanization of farming activities

- Major players in the industry focus on research and development activities to develop new technologies for manufacturing tires and integration across various stages of the value chain to gain a competitive edge in the market.