JUN 2020 | Report Format: Electronic (PDF)

Osteosynthesis Devices Market Growth & Trends

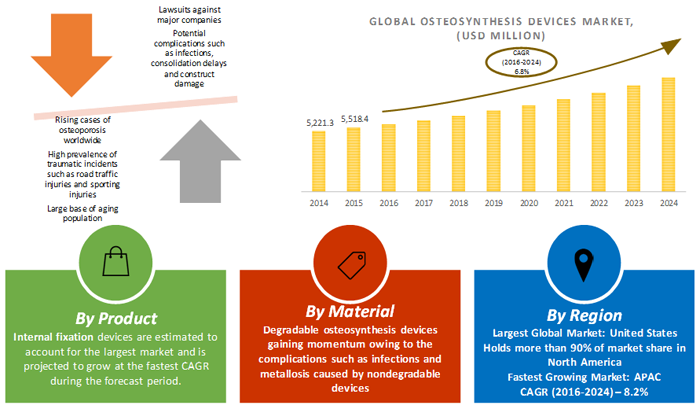

The osteosynthesis devices market size is expected to reach a value of USD 9.9 billion by 2024, according to a new report by Grand View Research, Inc. The worldwide prevalence of conditions like osteoporosis and osteomalacia, coupled with heavily occurring road traffic injuries/accidents and sporting injuries support the demand for osteosynthesis devices worldwide.

Osteoporosis, a disease resulting in weakening of bones is responsible for causing more than 8.9 million fractures annually. Forearm, humerus, hip and spine are the most commonly affected areas in patients suffering from the disease. The incidence and economic burden of osteoporosis is increasing worldwide, and patients 65 years old or over are at maximum risk of getting affected.

The geriatric population accounted for 46.2 million in 2014, and is increasingly rising. It is projected that by the year 2060, the number of older population will be twice than that of 2014. The rising incidence of osteoporosis and increasing count of the geriatric population is expected to drive demand for osteosynthesis devices in the coming years.

On the other hand, road traffic deaths are at the focal point of a crisis facing public health and development. The WHO reported that accidents/injuries majorly affect the low- and middle-income countries. Road accidents can cause severe injuries such as broken bones and fractures and requires immediate orthopediccare and attention.

Request a free sample copy or view report summary:

www.grandviewresearch.com/industry-analysis/osteosynthesis-devices-market/request/rs1

Osteosynthesis Devices Market Report Highlights

- North America reported highest revenue growth in this market. U.S. is one of the most lucrative and commercially important markets for orthopedic device manufacturers. Furthermore, technical advancements and a growing aging population (14.5% of the U.S. population), coupled with increasing investments in healthcare sector is estimated to drive growth in the market.

- Asia Pacific is expected to be an attractive region for osteosynthesis devices. Asia Pacific is reported to be at a high risk for osteoporosis because of a reported rise in the elderly population.

- Internal fixation devices held a higher market share than external devices in 2015. Although complications such as infections, consolidation delays, and construct damage are causing concerns, this has indirectly led to the demand for new research and management options in the fight against osteoporosis and fractures.

- The development of absorbable and biocompatible internal bone fixation devices is responsible for leading the drive for constant innovation in the osteosynthesis devices market.

- Some of the key players in this industry include DePuy Synthes, Inc.; Smith & Nephew Plc; Stryker; Zimmer Biomet Holdings, Inc.; Globus Medical, Inc.; GS Medical, LLC; Life Spine, Inc.; MicroPort Orthopedics, Inc.; Néosteo SAS; and Precision Spine, Inc.