JUN 2020 | Report Format: Electronic (PDF)

The global hospital information systems market size is expected to reach USD 39.7 billion by 2025 according to a new report by Grand View Research, Inc. The growing demand to reduce the wastage of healthcare budgets, minimize the risk of errors, and streamline the workflow of hospitals for improved outcomes are the key contributors to the market expansion.

There is a paradigm shift from traditional approach of paper-based manual operations to paperless IT-based solutions in hospital management. The growing number of government initiatives across the globe is accelerating the deployment of such technology. In 2016, the National Governors Association Center for Best Practices Health Division published a roadmap with an aim of improving the exchange of critical health data across different health entities.

The IT companies and healthcare organizations are collaborating at a greater level to develop high utility services and products to improve overall hospital administration. For instance, IBM and Cleveland Clinic have announced their 5-year agreement to expand Cleveland Clinic’s health IT technologies. Another example is partnership between Hospira and Latric Systems to work toward developing two-way communication between EMRs andHospira’s smart infusionpumps.

Technological advancements such as adoption of EHR, eHealth platforms, cloud computing, Picture Archiving and Communication System (PACS), Radiology Information Systems (RIS), web-based technology, Software as a Service (SaaS) are gaining momentum in the medical sector.

To request a sample copy or view summary of this report, click the link below:

www.grandviewresearch.com/industry-analysis/hospital-information-systems-his-market

Further Key Findings from the Study Suggest:

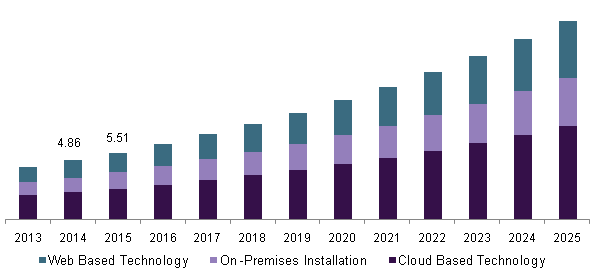

- In 2015, cloud-based technology was the dominating segment owing to cost considerations and data storage capacity

- Software segment was the leading segment in 2015 due to growing need for IT infrastructure in hospital management

- North America dominated the market in 2015. The U.S. is the largest market in North America due to the high adoption of such systems as a result of government initiatives and sophisticated healthcare facilities

- Asia Pacific is expected to be the fastest growing owing to the improving infrastructure in the emerging economies, increasing government spending on healthcare, and rising adoption of advanced technologies

- The market dynamics indicate the presence of strong competition amongst the key players like Carestream Health; GE Healthcare; Philips Healthcare; Cerner Corporation; NextGen Healthcare; Merge Healthcare (IBM), and many others