May 2020 | Report Format: Electronic (PDF)

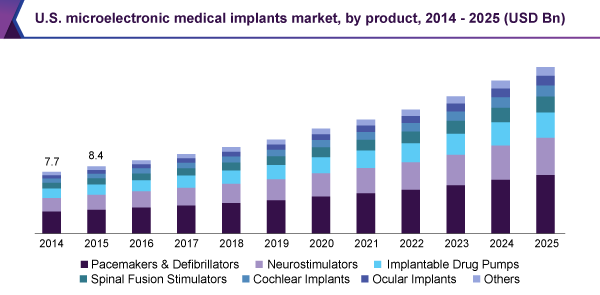

The global microelectronic medical implants market size is anticipated to reach USD 57.12 billion by 2025, according to a new report by Grand View Research, Inc., registering a 9.8% CAGR during the forecast period. Increasing prevalence of cardiac disorders, epilepsy, and Parkinson’s disease, growing regulatory approvals for new devices and equipment, rising geriatric population, and introduction of new products are key factors driving market growth.

Regulatory authorities such as U.S. FDA have approved several new products and devices to be used by end users, most of which are equipped with new and innovative technologies that cater to varied consumer demands. These technologies also increase the ease of use of these products. For instance, in July 2017, Cochlear Ltd. introduced to the market a cochlear implant sound processor for iPhone. The U.S. FDA approved this innovation in June 2017.

Increasing prevalence of diseases such as epilepsy, cardiac disorders, and Parkinson’s disease have upped the sales of microelectronic electronic implants such as defibrillators, pacemakers, and neurostimulators. As per WHO, approximately 50 million people have epilepsy, globally, making it one of the most common neurological disorders. The condition can be treated using neurostimulators that prevent seizures.

To request a free sample copy of this report, click the link below:

www.grandviewresearch.com/industry-analysis/microelectronic-medical-implants-market

Further key findings from the study suggest:

- By product, the pacemakers and defibrillators segment accounted for the largest share in 2016 owing to increasing prevalence of cardiovascular diseases and rising geriatric population

- RF technology accounted for the largest share in 2016 as it is employed in wireless implants and helps researchers and clinicians monitor patient health, capture physiological data, and study normal and abnormal functioning of the body

- North America commanded the largest share in the microelectronic medical implants market in 2016 and is expected to maintain its position over the forecast period. This is owing to favorable government policies, increasing FDA approvals for various medical devices in U.S., and high incidence of cardiac diseases

- Key market players include Zimmer Biomet Holdings, Inc.; Cochlear Ltd.; Medtronic plc; Abbott Laboratories; Zoll Medical; Boston Scientific Corporation; LivaNova PLC; Biotronik; Schiller; and Koninklijke Philips N.V.