May 2020 | Report Format: Electronic (PDF)

The global mobile virtual network operator market size is expected to reach USD 109.9 billion by 2027, registering a CAGR of 7.6% from 2020 to 2027, according to a new report by Grand View Research, Inc. The growing demand for data services and the increasing number of mobile users across the globe is expected to drive the market. In addition, the increasing number of services such as cloud, Machine to Machine (M2M), and mobile money are further expected to drive demand for mobile virtual network operators over the forecast period.

The growing demand to access mobile applications, social media, and multimedia services is further expected to propel the growth of the market over the forecast period. The declining prices of smartphones are contributing to the accelerating subscriber penetration across the globe is expected to fuel the growth of the market. Furthermore, increasing partnerships formed by key players for providing high-speed data services to consumers is anticipated to drive market growth over the forecast period.

Favorable government guidelines for mobile virtual network operators (MVNOs) allow them to access the Single Wholesale Network (SWN) and the mobile operator networks, as well as eliminate national roaming charges. This is expected to drive the growth of the market over the forecast period. The increasing government initiatives, such as the Digital Single Market (DSM) strategy, to eliminate copyright issues and geo-blocking problem and to provide better network service access for consumers in the Europe is expected to drive growth of the market over the forecast period.

The presence of a large number of players in the MVNO market has led to increased competition among service providers. This has led companies to offer mobile services at cheaper rates, which is expected to strengthen the market growth. The mobile virtual network operator model is considered cost-effective and time-efficient to enter in the telecom market to benefit the customers. This is expected to provide potential opportunities for new entrant in the market over the next eight years.

A sample copy of this report, click the link below:

www.grandviewresearch.com/industry-analysis/mobile-virtual-network-operator-mvno-market

Further key findings from the report suggest:

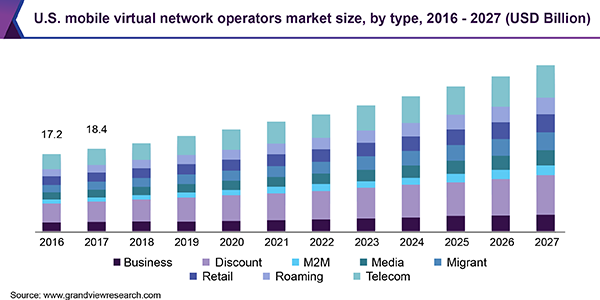

- The discount segment is expected to register phenomenal growth over the next eight years. High competition among mobile virtual network operator service providers to provide better and low-cost services coupled with the growing consumer preference for services offered at a discount is expected to drive the demand for the discount segment

- The service operator segment is expected to witness the fastest CAGR over the forecast period as it provides various service platforms such as voicemail and missed call notification

- The consumer segment is projected maintain its dominance over the next eight years. This growth can be attributed to mobile virtual network operators that provide customer centric offerings such affordable data and voice plans and latest technology

- Asia Pacific is expected to emerge as the fastest-growing regional mobile virtual network operator market over the forecast period. The growing demand for an efficient cellular network coupled with increasing speed of mobile broadband are expected to propel the growth of the market in Asia Pacific region.

- Key industry participants in the market include Lebara Group; Lyca Mobile; TalkTalk Group; Giffgaff; Poste Mobile SpA; Virgin Mobile; and TracFone Wireless Inc.