May 2020 | Report Format: Electronic (PDF)

The global biopharmaceutical excipients market size is projected to reach USD 3.0 billion by 2027, exhibiting a CAGR of 5.9%, according to a new report by Grand View Research, Inc. The demand for biopharmaceutical excipients is anticipated to increase given that several biologicals will be expiring over the next few years. Rapidly evolving development and manufacturing of biosimilars are further contributing to the increasing demand for novel biopharmaceutical excipients. Continuous advancements in the pharmaceutical industry, reduced time taken for manufacturing products, and outsourcing also significantly drive the product demand.

The concept of multifunctional or smart excipients has piqued the interest of market participants owing to their enhanced compressibility and drug release ability. Moreover, they have the ability to overcome challenges associated with drug formulation such as complex drug manufacturing processes and high costs associated with incorporating these products in drugs.Maintaining drug stability while reducing overall costs associated with drug development is of utmost importance to achieve large-scale commercial biopharmaceutical manufacturing.

Thus, market players are investing in the development of multifunctional excipient products to sustain intensifying competition in the industry. Various commercial multifunctional/smart excipients include Ludipress (BASF SE), F-MELT (Fuji Chemical Industries Co., Ltd.), Galen IQ 721 (BENEO-Palatinit GmbH), and MCC SANAQ (Pharmatrans-Sanaq AG).

Inquiry Before Buying: www.grandviewresearch.com/inquiry/5683/ibb

Further key findings from the report suggest:

- Increasing focus of pharmaceutical players on utilizing recombinant protein and monoclonal antibodies for bio-generic drug development is expected to drive the biopharmaceutical excipients market growth in the coming years

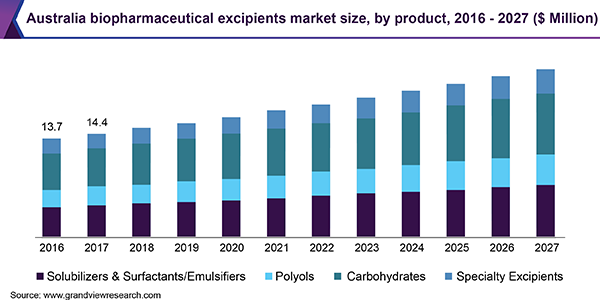

- Solubilizers and surfactants/emulsifiers accounted for a significant share in 2019 as they help maintain adequate efficacy of preservatives or antimicrobials in drug formulations

- Polyols are anticipated to exhibit the fastest growth in terms of revenue from 2020 to 2027, as they are gaining significant traction across the latest drug formulations such as chewable tablets and lozenges

- North America dominated the overall market in terms of revenue whereas Asia Pacific dominated the market in terms of volume in 2019

- Key industry participants include Roquette Frères, Spectrum Chemical Manufacturing Corp., Merck KGaA, Colorcon, and BASF SE

- Companies are inclined toward strategic agreements to maintain their market position. For instance, in February 2019, ABITEC (SPI Pharma) entered into a distribution agreement with Indchem International to distribute ABITEC’s functional lipid excipient product line into the personal care, nutrition, and cosmeceutical markets in India