May 2020| Report Format: Electronic (PDF)

Global biological implant market is anticipated to reach USD 9.8 billion by 2024, according to a new report by Grand View Research, Inc. Biological implant market is driven by rise in adoption of grafts and organ substitutes for reconstructive surgeries for various clinical applications such as cardiovascular, orthopedic and other soft tissue repair. The main challenge associated with the use of these products is to incorporate such a material that can specifically adapt to the biology of the surrounding environment in order to accelerate regeneration and repair. To overcome this challenge, research endeavors are carried out in order to develop such devices from biological source thus affecting industrial growth in the coming years.

Modification in the process of composite grafting is expected to play a crucial role in tackling reimplantation of amputated fingertips by bringing development in the overall process of grafting. Moreover, rising competition amongst key participants operating in this market is one of the high impact rendering factors to accelerate the growth.

Download PDF, click the link below:

www.grandviewresearch.com/industry-analysis/biological-implants-market

Further key findings from the report suggest:

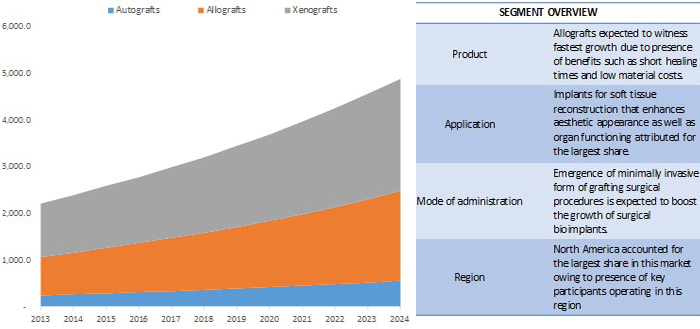

- Depending upon the source or donor of grafts, products offered can be categorized into autograft, allografts, and xenografts. Xenografts dominated the revenue share in 2015 with a revenue share of over 50%. However, allografts are expected to witness the fastest growth owing to the fact that they are derived from same species and produce considerably less chances of foreign immune reaction, thereby influencing adoption rate.

- Biological implants serve various application domains which include cardiovascular, orthopedic, and other soft tissue implants. Soft tissue products accounted for the largest share in 2015 as a result of higher usage of the products in the field of dentistry. Even though cardiovascular implants accounted for lowest penetration in the current scenario, demand for cardiovascular stents and valves obtained from biological source is expected to expand, consequently boosting revenue generation from this segment.

- Amongst surgical and injectable mode of administration, surgical mode is estimated to hold the larger share, as a consequence of availability of several products administered via this route. Introduction of minimally invasive techniques for surgical incorporation of grafts is also one of the significant factors propelling growth in this segment.

- North America dominated the market with a revenue share of 50% due to widespread presence of participants coupled with high aesthetic and healthcare awareness levels amongst the population in this region.

- Asia Pacific is estimated to exhibit the fastest growth in the coming years due to presence of the target population and rapidly improving health care infrastructure which is attributed to drive the demand for tissue engineered products and biological implants.

- Major players operating in this industry include Medtronic, NuVasive, Inc, Stryker Corporation, Conmed Corporation, CryoLife, Edwards LifeSciences Corporation, Acelity, Integra LifeSciences Corporation, Allergan Plc, RTI Surgical, IOP Ophthalmics, Organogenesis Inc, BioPolymer GmbH & Co. KG, Osiris Therapeutics, Baxter International, Vericel, Aplhatec Spine Inc, Maxigen Biotech Inc, Auto Tissue Berlin GmbH, MiMedx Group, Inc., Biotissue Technologies,

- These players are undertaking different business strategies to boost their respective penetration and enhance market presence. These strategies include novel product developments and geographic expansion by involving in collaborative activities in order to grab the larger share of revenue. For instance, in April 2016, Stryker Corporation acquired Stanmore Implants Worldwide Limited which is expected to enable the company to provide differentiated technologies to orthopedic oncology surgeons, thus propelling growth over the forecast period.