The global aerospace parts manufacturing market size is expected to reach USD 1.25 trillion by 2027, exhibiting a CAGR of 4.1% over the forecast period, according to a new report by Grand View Research, Inc. Increasing passenger and freight traffic in emerging economies is driving the demand for next-generation aircraft, which in turn is expected to boost the market growth.

A majority of the aircraft manufacturing companies are integrated across the value chain and are highly active in the parts manufacturing process. These companies have in-house production facilities as well as supplier contracts for the procurement of these parts. The manufacturers are also involved in raw material procurement and designing and quality control of the parts offered by third party suppliers.

The market for aerospace part manufacturing is primarily concentrated in North America and Europe, owing to the presence of major aircraft manufacturers. China and India are expected to emerge as the leading markets in the forthcoming years, owing to the rapid growth of aircraft part manufacturing and export activities. The global trade in components and sub-assemblies has increased by approximately 25% during the past decade. However, the sector still remains consolidated with the top 3 countries including U.S., Germany, and France, accounting for over 60% of the total aircraft manufacturing.

The market has observed a trend of a collaboration of the major companies entering into a joint venture. This helps the companies to sustain in the highly competitive market in terms of geographical expansion, technological advancements, and lowering the risk of failure. This also aids the companies to easily access the market for gaining long term contracts.

Curious to know more? (Request a Free Sample) Click the link below:

Further key findings from the report suggest:

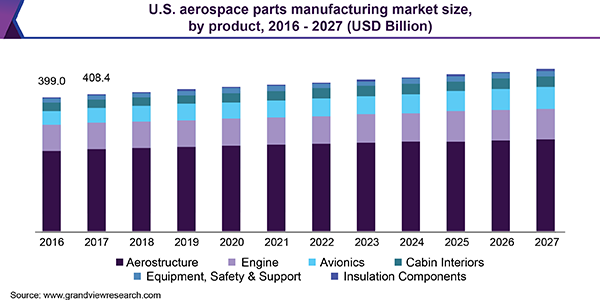

- In 2019, aerostructure dominated the product segment, with 52.2% of revenue share on account of strong replacement rate of aluminum with high-cost composites in fuselage and airframe structures

- Commercial aircraft segment is estimated to expand at the fastest CAGR of 4.6% over the forecast period, as significant changes are being incorporated in the aircraft structure to reduce the carbon emissions by replacing existing parts with lightweight materials

- The market in Asia Pacific was valued at USD 149.6 billion in 2019 and is expected to expand at the highest CAGR owing to the rapid growth of aviation industry, augmenting the growth of MRO services thereby impacting aerospace parts manufacturing industry on a positive note

- The aerospace parts manufacturing market has stringent manufacturing norms, safety regulations, and certifications, which restricts the entry of new entrants

- Emerging players in Asia offering low-cost innovative solutions to the end-users are expected to challenge the established players in North America and Europe, leading to competition disruption in the market

Grand View Research has segmented the global aerospace parts manufacturing market on the basis of product, end use, and region:

Aerospace Parts Manufacturing Product Outlook (Revenue, USD Billion, 2016–2027)

- Engines

- Aircraft Manufacturing

- Cabin Interiors

- Equipment, System, and Support

- Avionics

- Insulation Components

Aerospace Parts Manufacturing Aircraft Outlook (Revenue, USD Billion, 2016–2027)

- Commercial Aircraft

- Business Aircraft

- Military Aircraft

- Others