Online Food Delivery Services Market Revenue Reach $6.4 Billion | Global Industry Report Forecast 2025 | Market Research Report

The global online food delivery services market size is expected to reach USD 6.4 billion by 2025, registering a CAGR of 15.4% over the forecast period, according to a study conducted by Grand View Research, Inc. The market growth can be attributed to the availability of several delivering platforms and significant shift from using websites to using mobile application services for ordering food. The increasing internet & smartphone penetration among millennials and growth of the food & beverage industry are some factors anticipated to drive the market growth.

Food delivery services offer various benefits such as doorstep delivery, significant discounts, cashback offers, and multiple payment options for attracting users. Furthermore, with the rising per capita income, middle-class and high-income populace in developing economies are witnessing significant changes in their living standards and eating preferences. Such favorable changes in lifestyle are expected to contribute to the market growth over the forecast period.

Moreover, smartphones enable customers to order food quickly & conveniently and using multiple payment options. Most consumers ordering food prefer their orders to be delivered at their doorstep. Thus, the increasing penetration of smartphones and internet is encouraging users in developing countries to install food delivery apps.

Companies are emphasizing on enhancing logistics capabilities and consumer experiences. Additionally, adequate funding and investments in the market is one of the factors expected to drive the market growth. For instance, in February 2019, Zomato raised approximately USD 62.2 million in a funding round from multiple investors that included Delivery Hero, Naspers Limited, Chunwei Capital, and others.

Numerous companies are adopting optimized delivery modes, which can considerably speed up delivery and reduce operational costs. Food delivery using robots, drones, and parachutes are gaining traction in the market. Such technological advancements in the online food delivery industry are anticipated to provide opportunities for market growth.

“Read Report Summary, Toc, Market Segmentation, Research Methodology, Request a Free Sample“ Click the link below:

Further key findings from the study suggest:

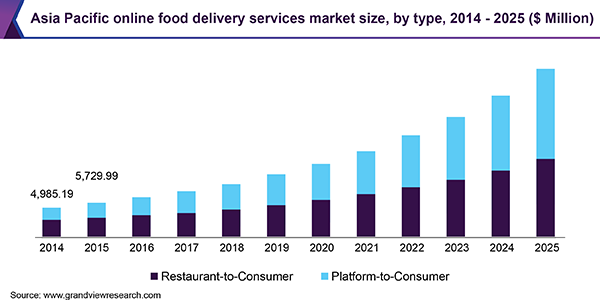

- The platform-to-consumer segment is expected to register a CAGR of more than 12.0% owing to the growing adoption of new app models that offset logistics costs

- The restaurant-to-consumer segment accounted for more than 40% of market share in 2018 owing to the focus of aggregators on maintaining their market presence through implementation of cloud kitchens

- The growth of the mobile applications segment can be attributed to the availability of several food delivering platforms for customers and growing use of mobile applications to place orders

- The online payment method is expected to register a noteworthy CAGR of over 15% owing to growing digitalization and adoption of cashless transactions in developing economies

- Asia Pacific is expected to witness substantial growth owing to the rising disposable income, upgradation of retail formats, and increase in number of internet users & adoption of smartphones

- The online food delivery services market is highly fragmented with the presence of established, local players. The key players operating in the market include GrubHub and Postmate Inc., among others

- The major players are focusing on introducing attractive plans to increase their customer base.

Grand View Research has segmented the global online food delivery services market based on type, channel type, payment method, and region:

Online Food Delivery Services Type Outlook (Revenue, USD Million, 2014–2025)

- Restaurant-to-Consumer

- Platform-to-Consumer

Online Food Delivery Services Channel Type Outlook (Revenue, USD Million, 2014–2025)

- Websites/Desktop

- Mobile Applications

Online Food Delivery Services Payment Method Outlook (Revenue, USD Million, 2014–2025)

- Cash on Delivery

- Online