The global wireless in-flight entertainment (W-IFE) market is expected to reach USD 3.53 billion by 2025, according to a new report by Grand View Research, Inc. Increased proliferation of mobile devices, such as smartphones, laptops, and tablets, has prompted airlines to start offering wireless in-flight connectivity & entertainment services to passengers, thereby providing them access to a wide spectrum of stored as well as streaming entertainment content and other connectivity services on their personal devices.

In the U.S., the Federal Communications Commission (FCC), in conjunction with the Federal Aviation Authority (FAA) has permitted the use of Portable Electronic Devices (PEDs) inside the aircraft with implementation guidelines. This regulatory change is expected to pave the way for new and innovative W-IFE solutions. The combination of wireless in-flight connectivity and in-flight entertainment has opened several opportunities for the overall industry growth, such as streaming live movies, live content, and other Advertising Video-On-Demand (AVOD) services.

There has been an increased number of partnerships among connectivity service providers across the globe for achieving enhancements in their service portfolios and providing high-speed connectivity services at economical rates. Recently, Inmarsat plc., a mobile satellite communication provider, collaborated with ViaSat, a digital communications provider, to develop new mobile satellite communication.

Companies developing software for entertainment systems for W-IFE hardware and equipment are anticipated to grow at a phenomenal rate in line with the rising demand for dynamic entertainment solutions. Leading content providers, such as Global Eagle Entertainment Inc. (GEE) and Stellar Entertainment, are expected to grow at a considerable rate, leveraging the unique content services they offer via the streamed as well as the stored channels.

At present, airlines across the globe are investing significantly towards the implementation of contemporary satellite broadband and connectivity technologies, in order to meet the growing expectations of passengers. With the growth in wireless connectivity and increasing adoption of the Bring Your Own Device (BYOD) trend, passengers are increasingly preferring wireless services for in-flight entertainment and connectivity.

The BYOD trend has prompted many airlines to eliminate the back-seat IFE systems, thereby reducing the overall weight and increasing the saving on fuel costs. This is particularly helping the cost competitive airlines to reduce their fares while still delivering a substantial IFE experience.

“Read Report Summary, Toc, Market Segmentation, Research Methodology, Request a Free Sample“ Click the link below:

Further key findings from the report suggest:

- Gogo Inc. and GEE have emerged as the leading early adopters of the contemporary W-IFEC trend and have started integrating their content delivery services with the in-flight entertainment demand accordingly

- The launch of High-throughput satellite (HTS), to deliver high-speed connectivity services, is anticipated to supplement the ongoing developments in the satellite connectivity domain.

- European carriers are closely following their counterparts in the U.S. For instance, British Airways is rolling out the new ATG network on their aircraft, which is expected to be compatible with the ATG network deployed by Deutsche Telecom across the EU.

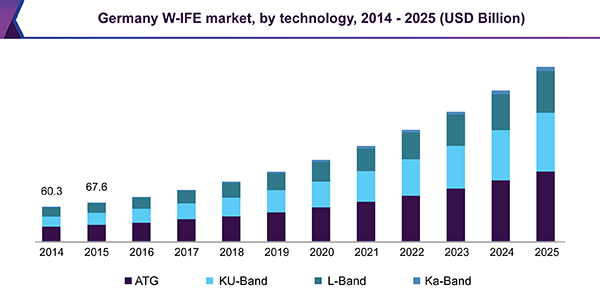

- Ka-band connectivity solutions are expected to witness a CAGR of over 20% from 2017 to 2025 and are expected to outperform the services offered over the Ku-band in terms of cost as well as speed

“Would you like/ try a Free Sample Report” Click the link below:

Grand View Research has segmented the global Wireless In-Flight Entertainment (W-IFE) market on the basis of aircraft type, fitment type, hardware, technology, and region:

Aircraft Type Outlook (USD Million; 2014–2025)

- Narrow-Body

- Wide-Body

- Regional Jet

Fitment Type Outlook (USD Million; 2014–2025)

- Retrofit

- Line Fit

Hardware Outlook (USD Million; 2014–2025)

- Antennas

- WAPs

- Modems

- Others

Technology Outlook (USD Million; 2014–2025)

- ATG

- Ku-Band

- L-Band

- Ka-Band

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

Request for Customization: www.grandviewresearch.com/request-for-customization/4841/rfc