The global serverless architecture market size is expected to reach USD 19.84 billionby 2025 at a 26.0% CAGR during the forecast period, according to a new study by Grand View Research, Inc. Growing demand for economizing operations and increasing profitability has been driving the market. Emergence of cloud technology, coupled with advancements in serverless computing, has further strengthened the market. As the business model of serverless operations is execution based, enterprises can eliminate the cost of provisioning and maintaining the server round the clock. Charges are billed on number of executions, which in turn, reduces cost.

Application development processes are a major beneficiary of a serverless architecture. DevOps and agile development culture within an organization are driving enterprises to change the way they develop business applications fundamentally. Monolithic applications are paving the way for application programming interface (API), micro-services, and function-based execution units, resulting in a paradigm shift of organizational mindset. These trends have changed the way enterprises approach IT infrastructure. In such an environment, serverless architecture enables organizations to streamline their operations, hire optimal resources, and allow developers to focus on core product development.

Cloud service providers (CSP) manage serverless architecture, enabling the platform to provide automatic scaling, enterprise-level global security, and promote continuous building, integration, and development efforts. Such factors positively impact an enterprise’s time-to-market, market share, and sustainability.

From a business perspective, serverless architecture eliminates the cost of hiring back-end infrastructure engineers, provides process agility, and reduces overall operational cost by a significant amount. From a developer perspective, it offers reduced liability and zero system administration as well as fosters adoption of microservices and nano-services.

However, there are several risks involved in deploying serverless architecture. As CSPs control the underlying infrastructure, users cannot customize/optimize the infrastructure to suit specific needs of an enterprise and developer. Moreover, as the organization has no control over the infrastructure, adding multiple customers on the same platform may raise security concerns. Furthermore, as a consumer, there is no authorization to do penetration tests and vulnerability scanning on infrastructure underlying the serverless offerings. Thus, increasing need for compliance concerns adopters and thereby acts as a restraint to market growth.

To request a sample copy of this report, click the link below:

Further key findings from the study suggest that:

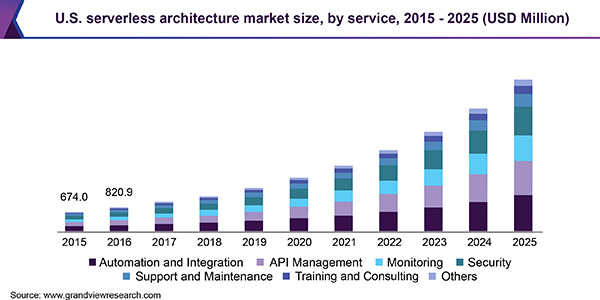

- By service, the monitoring segment is anticipated to register the highest CAGR of 28.8% over the forecast period. The automation & integration service segment, on the other hand, holds the dominant share and was valued at USD 830.6million in 2017

- Based on organization, the large enterprises segment is expected to retain its dominance in the market, valuing an estimated USD 13.80 billion by 2025. The SME segment is anticipated to register the highest CAGR of 28.6% over the forecast period

- By way of vertical, media & entertainment is expected to register the highest CAGR of 30.3% over the forecast period

- North America was valued at USD 1.32 billion in 2017 and is expected to hold a dominant revenue share in the market by 2025. Asia Pacific is anticipated to witness the highest CAGR of 29.7% over the forecast period

- Key players in the market include Amazon Web Services Inc.; Google LLC; Microsoft Corporation; and Oracle Corporation.

Grand View Research has segmented the global serverless architecture market on the basis of service, organization, vertical, and region:

Serverless Architecture Services Outlook (Revenue, USD Million, 2015 - 2025)

- Automation and Integration

- API Management

- Monitoring

- Security

- Support and Maintenance

- Training and Consulting

- Others

Serverless Architecture Organization Outlook (Revenue, USD Million, 2015 - 2025)

- Large Enterprise

- SME

Serverless Architecture Vertical Outlook (Revenue, USD Million, 2015 - 2025)

- BFSI

- Government & Public

- Healthcare & Life Sciences

- Manufacturing

- Media & Entertainment

- Retail & E-commerce

- Telecom & IT

- Others