The global payment security market size is expected to reach USD 43.76 billion by 2025, according to a new report by Grand View Research, Inc., progressing at a CAGR of 12.3% during the forecast period. Rising need for PCI DSS (payment card industry data security standard) compliance and adoption of digital payment mode by consumers are likely to stoke the growth of the market. The payments industry is going through a movement of infrastructure transformation, which is essential to compete efficiently with non-bank trendsetters and address progressing customer requirements.

Over the past few years, major economies have modernized their payment infrastructures and many others are scheduling to upgrade. Digital payments aid merchants in maintaining continuous compliance with PCI DSS, which is further anticipated to bolster the growth of the payment security market. In March 2015, Worldpay noted over 133,000 fraudulent transactions reported, which interpreted stolen card details being used every 20 seconds. Thus, payment security providers help its customer's systems to protect itself from threats and aim to provide secure businesses by getting them to comply with PCI DSS. Therefore, the payment security market is estimated to be driven by the adoption of PCI DSS compliance.

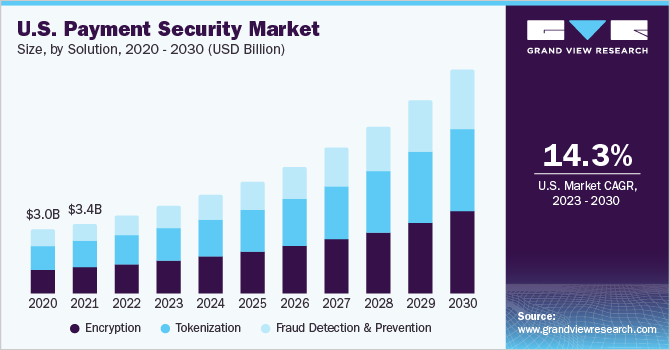

Fraud detection and prevention solutions hold the largest share in the overall market. These solutions provide various fraud analytics solutions such as big data and predictive analytics. Big data and predictive analytics helps to detect and avoid frauds.

To request a sample copy of this report, click the link below:

Further key findings from the report suggest:

- The global payment security market had a valuation of USD 15.79 billion in 2017

- Encryption platform emerged as the fastest growing segment over the forecast period

- Large enterprises represented the leading segment in terms of organization in 2017 and are projected to generate revenue over USD 29.80 billion by 2025

- The education market is poised to witness the highest CAGR of 13.4% over the forecast period

- North America was the leading revenue contributor in 2017. Rising number of startups in the retail industry and presence of prominent payment security providers in the region is expected to drive the North America payment security market

- Key players include Braintree, CyberSource, Ingenico, and Index among others. These players commanded the leading revenue share in the market in 2017.

Grand View Research has segmented the global payment security market on the basis of solution, platform, organization, application, and region:

Payment Security Solution Outlook (Revenue, USD Million, 2014 - 2025)

- Encryption

- Tokenization

- Fraud Detection & Prevention

Payment Security Platform Outlook (Revenue, USD Million, 2014 - 2025)

- Web based

- POS based

Payment Security Organization Outlook (Revenue, USD Million, 2014 - 2025)

- Small and Medium Enterprises

- Large Enterprises

Payment Security Application Outlook (Revenue, USD Million, 2014 - 2025)

- Retail & ecommerce

- Travel & Hospitality

- Healthcare

- Telecom & IT

- Education

- Media & Entertainment

- Others

Payment Security Regional Outlook (Revenue, USD Million, 2014 - 2025)

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Italy

- Turkey

- Sweden

- Spain

- Poland