The global automotive brake systems market is expected to reach USD 31.11 billion by 2025, according to a new study by Grand View Research, Inc. The market is highly influenced by vehicle production as a brake system is an integral part of a vehicle. The rising vehicle production and sales, owing to growing disposable income, is expected to propel the market growth.

The primary objective of brake systems is to reduce vehicle speed and halt the vehicle. However, a moving vehicle is subject to numerous uncertainties. The use of advanced systems ensures vehicle halt and enables consistent vehicle control, which proves vital in avoiding an accident, thereby, ensuring optimum vehicle safety.

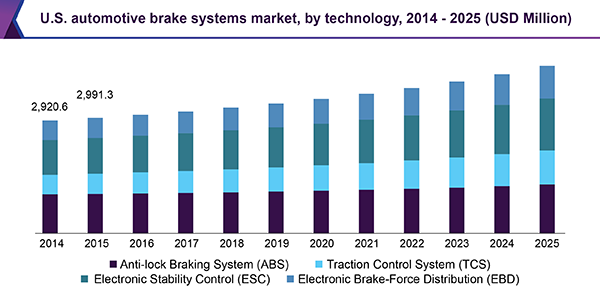

The increased use of electronic components is one of the key contributing factors for market growth. The use of electronic components has led to the development of technologies such as Antilock Braking System (ABS), Traction Control System (TCS), Electronic Stability Control (ESC), and Electronic Brake-Force Distribution (EBD). The adoption of these advanced technologies, coupled with growing popularity of vehicle safety among consumers, is presumed to drive the market. However, the high cost of integration is the primary restraining factor for the widespread adoption of advanced braking systems. Thus, a majority of these systems are integrated solely in premium and luxury vehicles.

The key factor driving the growth of the automotive brake systems market is the growing stringency in vehicle safety norms. Automotive associations across the globe are working toward improving vehicle safety. For instance, in 2016, the U.S. Department of Transportation's National Highway Traffic Safety Administration (NHTSA) and Insurance Institute for Highway Safety (U.S.), along with 20 prominent vehicle manufacturers, have planned to incorporate Automatic Emergency Braking (AEB) systems as a standard feature in all new cars from September 2022. Similarly, in 2015, the Ministry of Road Transport and Highway (MoRTH), India, mandated the implementation of ABS in all commercial vehicles. Thus, the market is expected to grow steadily over the forecast period. However, lack of considerable efforts toward curbing counterfeiting of brake-related products is hampering the growth of the market and compromising vehicle safety.

To request a sample copy of this report, click the link below:

Further key findings from the study suggest:

- The disc brakes segment is projected to grow at a higher CAGR than drum brakes, owing to its enhanced braking performance and heat dissipation characteristics

- The passenger cars segment is anticipated to grow at the highest CAGR of 5.9% over the forecast period, owing to the rising passenger car sales in developing economies such as China and India

- The growing concerns over non-exhaust emission, caused due to brake abrasion, have propelled the need for eco-friendly brake materials

- Asia Pacific is projected to account for 53.6% of the total market share by 2025, owing to increasing vehicle production and popularity of vehicle safety features

- The key companies, such as Aisin Seiki Co., Ltd., Brembo S.p.A., Continental AG, and Robert Bosch GmbH, have made huge investments in R&D activities to strengthen their production capabilities

Grand View Research has segmented the automotive brake system market based on types, technologies, vehicle types, and regions:

Type Outlook (Revenue, USD Million; 2014 - 2025)

- Disc Brake

- Drum Brake

Vehicle Type Outlook (Revenue, USD Million; 2014 - 2025)

- Passenger Cars

- Commercial Vehicles

Technology Outlook (Revenue, USD Million; 2014 - 2025)

- ABS

- TCS

- ESC

- EBD