The global industrial insulation market size is expected to reach USD 9.76 billion by 2025, at a CAGR of 5.1%, according to a new report by Grand View Research, Inc. Increasing usage of thermal insulation for industrial equipment to improve energy efficiency is expected to drive the growth.

The raw materials used to manufacture various industrial insulation products such as glass and stone wool are available in abundance. However, the price of insulation raw materials derived from petrochemicals is subject to a notable change as the crude oil prices fluctuate. This results in an increase in the supplier bargaining power.

The market is under high scrutiny from government environmental agencies including the Environment Protection Agency (EPA) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH). These agencies have imposed stringent regulations on the materials used for manufacturing these products. Government support to develop sustainable manufacturing practices is expected to propel technological advances aimed at production of eco-friendly products.

The industrial insulation market exhibits high entry barriers, owing to the presence of a large number of players. In addition, capital intensive nature of the market ensures the requirement of substantial amount of time, planning, and resources for market entry and sustenance. High production volumes realized by the major players has resulted in economies of scale which may discourage new entrants.

To request a sample copy of this report, click the link below:

Further key findings from the report suggest:

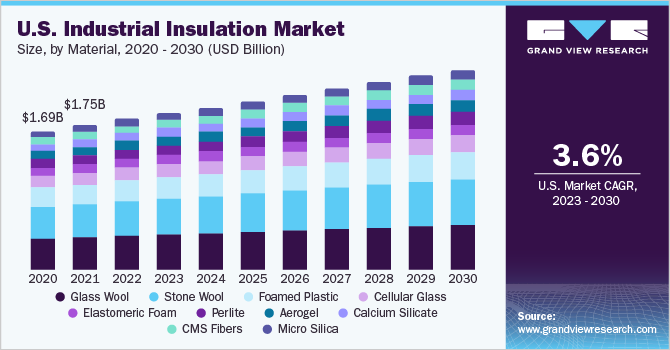

- Glass wool accounted for the largest market share of 22.3% in 2018, owing to its high temperature tolerance, flame resistance, and ability to offer thermal as well as acoustic insulation

- Pipe insulation accounted for the largest market share in 2018 and is estimated to reach USD 4.65 billion by 2025, owing to increasing demand from industrial plants for controlling and stabilizing the process temperatures and prevention of condensation to limit pipe corrosion

- Power generation is estimated to exhibit fastest CAGR of 6.9% in terms of revenue, from 2019 to 2025, owing to increasing product usage to minimize thermal losses

- Asia Pacific accounted for a revenue of USD 1.68 billion in 2018 and is expected to exhibit the fastest CAGR over the forecast period, attributed to the rapid economic developmentcoupled with rising adoption of such products

- Major companies operating in the industrial insulation market focus on extending their product portfolio through development of cost-efficient materials. They prioritize R&D of low-cost materials that provide superior insulating properties.

Grand View Research has segmented the global industrial insulation market on the basis of material, product, application, and region:

Industrial Insulation Material Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

- Stone Wool

- Glass Wool

- CMS Fibers

- Calcium Silicate

- Cellular Glass

- Foamed Plastic

- Perlite

- Aerogel

- Cellulose

- Elastomeric Foam

- Micro Silica

- Others

Industrial Insulation Product Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

- Pipe

- Board

- Blanket

- Others

Industrial Insulation Application Type Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

- Power Generation

- Petrochemical & Refineries

- EIP Industries

- LNG/LPG

- Others