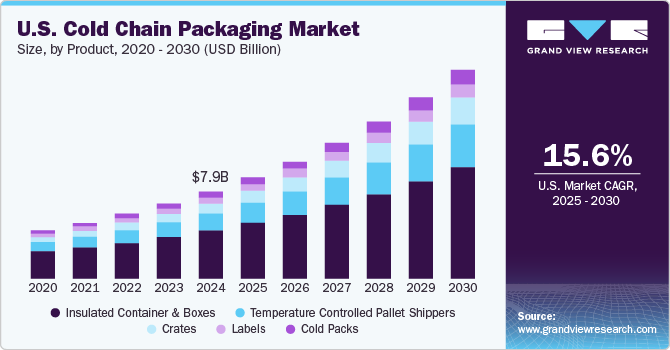

The U.S. cold chain packaging market

size is expected to reach USD 8.66 billion by 2025 at a 14.1% CAGR

during the forecast period, according to a new report by Grand View

Research, Inc. Market growth is profoundly influenced by extensive

demand for perishable goods worldwide and availability of food and

health supplies.

Current economic and political scenario has also played a

crucial role in industry growth. For instance, trade conflict between

U.S. and China is expected to negatively impact the growth of the cold

chain market in U.S. In March 2018, U.S. imposed a 25% tariff on steel

and 10% on aluminum imported from China. China, in turn, announced a

15-25% tariff on products imported from U.S., including pork, fruits,

wine, nuts, and vegetables. These high tariffs imposed on food and

agriculture produce is expected to negatively affect market growth.

Furthermore, outsourcing cold and frozen storage operations

offer manufacturers various cost benefits. This can help eliminate costs

associated with warehouse space and management, technology,

transportation, and labor. Operational costs such as employee salaries,

heating and cooling expenses, insurance, and electric power costs can

also be reduced by working with supply chain partners. As a result,

manufacturers can increase their profit margins and focus on core

business activities such as quality product manufacturing, growing

customer base, and satisfaction of customer needs.

Raw material suppliers in the cold chain packaging market

supply primary materials required for producing isolated containers, in

addition to other packaging components. Insulating materials used in

cold chain packaging include expanded or extruded polystyrene,

polyurethane, and polyethylene. These are manufactured using core

materials such as silica or fiberglass in a multilayer polymer or vacuum

aluminized coating. Thermal Conservation Technologies; va-Q-tec AG; and

Thermal Visions, Inc. are some of the raw material providers in U.S.

Cold chain packaging manufacturers use raw materials for

producing insulated containers. They are responsible for designing and

developing packaging solutions depending on user requirements. The raw

materials used vary depending on duration of temperature control

required for the packaged product as well as on external temperature.

Polystyrenes, polyurethane, and Vacuum Insulated Panels (VIP) are used

depending on external temperatures and duration of shipping.

Manufacturers develop packaging products depending on the industries

they would be used in as well as other aspects such as weight and size.

To request a sample copy or view summary of this report, click the link below: https://www.grandviewresearch.com/industry-analysis/us-cold-chain-packaging-market

Further key findings from the report suggest:

-

The U.S. refrigerated warehouse capacity was pegged at 2.92 billion cubic feet in 2017

-

Ammonia and carbon dioxide have been the most popular inorganic

refrigerants over the years and is expected to witness substantial

growth during the forecast period

-

Product manufacturers are focusing on understanding carrier ambient

environment in order to develop efficient packaging and devise risk

mitigation strategies

-

Companies offering solutions in cold chain packaging maintain a

network of distributors located in different regions. For instance,

Pelican BioThermal LLC has a network of dealers located in South America

(NatBio), Asia Pacific (Giddi Pharma, Pharmaserv Express, and others),

and Europe (DS Smith)

-

Some of the key industry participants are ACH Foam Technologies,

Inc.; Cold Chain Technologies, Inc.; Cryopak Industries, Inc.; Cold Box

Express, Inc.; and Intelsius.