The global probiotic ingredients market

size is projected to reach USD 3.56 billion by 2025, according to a new

report by Grand View Research, Inc. It is expected to expand at a CAGR

of 7.9% over the forecast period. Increasing consumer awareness

regarding preventive healthcare has emerged as a key market driver.

Probiotics play a great role in preventive healthcare as they prevent

the occurrence of a disease by strengthening the immune system of the

body.

Another significant factor bolstering the product demand

across the globe is the increasing investments by key market players in

R&D activities with respect to the development of efficient

probiotic strains. There have been advancements in the delivery systems

used for delivering probiotics in the human body. Efficient strains have

been developed that work in compatibility with these delivery systems.

This allows a high number of probiotics to reach the body parts such as

the intestines, thus increasing their effectiveness.

Companies have developed and identified proprietary strains

for specific applications. These strains meet different requirements

possessed by different medical conditions. Lactobacillus fermentum

VRI-003 PCC and Lactobacillus rhamnosus HN001 are used to cure Eczema.

Lactobacillus acidophilus NCFM and Bifidobacterium animalis lactis Bi-07

strains are used to cure cold. Lactobacillus acidophilus, Lactobacillus

reuteri RC-14, and Lactobacillus rhamnosus GR-1 are effective for

treating vaginal infection.

Europe emerged as the largest probiotic ingredients market

in 2018, with a revenue of USD 742.2 million. Rising awareness

concerning gut and immune health, prevalence of gut-related diseases,

and the presence of geriatric population are some of the key factors

contributing significantly to the regional market growth. Increasing

consumption of animal probiotic ingredients is anticipated to further

fuel the regional expansion. Increasing focus on mortality reduction and

growth of animals coupled with the need for feed conversion efficiency

is expected to trigger the regional demand.

The market participants have been engaging in mergers and

acquisitions in a bid to increase their market share. For instance, in

December 2017, Royal DSM, a science-based company headquartered in

Netherlands announced the acquisition of Biocare Copenhagen A/S, a

Denmark-based food supplements manufacturing and supplying company. The

acquisition was intended to expand the former’s product offerings of

probiotic gut health ingredients.

To request a sample copy or view summary of this report, click the link below: www.grandviewresearch.com/industry-analysis/probiotic-ingredients-market

Further key findings from the report suggest:

-

In terms of ingredient, bacteria emerged as the largest segment with a

revenue of USD 1.74 billion in 2018. The segment is expected to

continue its dominance over the forecast period

-

In terms of application, probiotic dietary supplements segment is

anticipated to expand at the fastest CAGR of 8.2% over the forecast

period, attributable to the increasing demand for these supplements from

various industries including pharmaceutical, nutraceutical, and

functional supplements

-

In terms of end use, human probiotics segment is expected to lead the

market over the forecast period, with animal probiotics segment at a

distant second. Advancement in oral probiotic market has contributed to

the growth of the human probiotics segment

-

Asia Pacific is anticipated to witness the fastest CAGR of 8.4% over

the forecast period. Led by countries such as India, China, and Japan,

the Asia Pacific probiotic ingredients market is driven by the

increasing adoption of the product predominantly in infant formula

-

The market is highly competitive with a sizable number of domestic

and international players sharing the market space. Product innovation

and mergers and acquisitions are among the key strategies deployed by

prominent players to withstand competition

-

The key market participants are Ganeden, Inc.; Probiotical S.p.A.;

Biocodex, Inc.; Sabinsa Corporation; BioGaia AB; Chr. Hansen Holding

A/S; and Lallemand, Inc. among others

Grand View Research has segmented the global probiotic

ingredients market on the basis of ingredient, application, end use,

form, and region:

Probiotic Ingredient Outlook (Revenue, USD Million, 2014 - 2025)

-

Bacteria

-

Lactobacilli

-

Bifidobacterum

-

Streptococcus

-

Other Genus

-

Lactobacilli

-

Yeast

-

Spore Formers

Probiotic Ingredients Application Outlook (Revenue, USD Million, 2014 - 2025)

-

Probiotic Food & Beverages

-

Probiotic Dietary Supplements

-

Animal Feed Probiotic

Probiotic Ingredients End Use Outlook (Revenue, USD Million, 2014 - 2025)

-

Human Probiotics

- Animal Probiotics

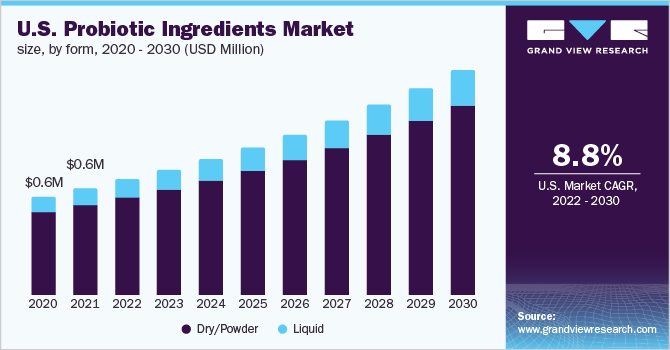

Probiotic Ingredients Form Outlook (Revenue, USD Million, 2014 - 2025)

-

Dry Form

-

Liquid Form