Industry Insights

According to the U.S. Energy Information Administration (EIA), the global energy consumption is growing at a rapid rate owing to the increased electricity consumption and transportation. This is further supported by the rising per capita income and the surge in the global GDP. The global economy has witnessed a steady growth over the last few years. Mature economies such as the U.S. and Europe witnessed an increase in their respective GDPs after 2011 owing to the capacity expansions in various industries, increased exports, and the rising incomes of individuals.

These services are being increasingly implemented owing to the rising demand for energy and the development of new oilfields.

The purpose of oilfield services is to help operators control the subsurface pressures, minimize formation damage, control borehole erosion, and optimize drilling parameters including the penetration rate and hole cleaning. The burgeoning offshore industry, particularly in the Persian Gulf, is anticipated to drive the oilfield services market over the forecast period. However, the adverse environmental effects of E&P activities coupled with strict government regulations are likely to hinder the market growth.

According to BP’s Energy Outlook 2017, the demand for natural gas is projected to witness maximum growth rate from 2008 to 2020. It is likely to record an estimated CAGR of 1.9% from 2012 to 2035, with a majority of this growth reported in non-OECD countries, outpacing the demand in the OECD member countries. The growing demand for energy, particularly for natural gas, has prompted the market to shift its focus toward oilfield services.

Try Free PDF Report Sample report, click the link below:

www.grandviewresearch.com/industry-analysis/oilfield-service-market

Application Insights

The increasing global offshore rig count, which recorded an annual average of over 4% in 2016, coupled with the significant development of existing offshore wells, both in deep and ultra deep waters, particularly in the South China Sea, Persian Gulf, and Gulf of Mexico, is estimated to drive the sector over the forecast period.

The growing need to increase the rates and efficiency of oil & gas production and to mitigate gas-related capital expenditures is likely to fuel the demand for oilfield services in offshore activities over the forecast period. The increasing number of ongoing projects in the Middle East & Africa, including the Maydan Mahzam and Bul Hanine fields, is projected to drive the market over the forecast period.

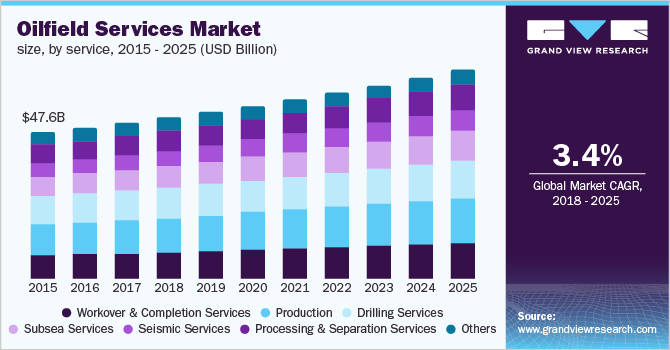

Service Insights

The rising need for energy, due to the growing population and rapid industrialization, has led to the requirement for large-scale exploration activities. Increasing participation to sustain the demand for energy in the region coupled with the growing number of deepwater discoveries is projected to drive the subsea segment over the forecast period. Companies such as Next Geosolutions and M2 Subsea have signed an agreement to carry out subsea survey operations at the Aberdeen port of Scotland. Manufacturers are shifting their focus toward the development of new solutions based on nanotechnology to overcome the existing technological and environmental challenges in drilling activities.

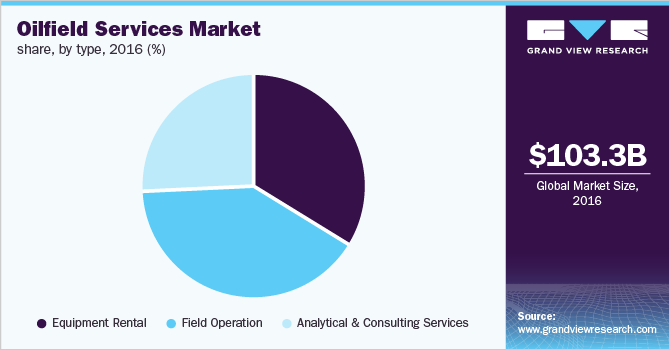

Type Insights

Field operation segment helps E&P companies attain their maximum operating limits within a specified time frame. These also include remote operations including repair & maintenance, extraction of resources, and monitoring. This segment thus helps companies minimize risks and is expected to drive the market at a steady rate over the forecast period. Predicting the outcome of field operations helps operators plan ahead of time. In case a mishap such as an oil spill occurs, operators are thus likely prepared to manage the situation.

Analytical & consulting solutions help E&P companies analyze the surface or the rocks to be drilled without actual drilling. This segment employs techniques, such as optimization, simulation, mathematical testing, and experimental designs along with scientific methods to come up with the best possible solutions to meet the needs of E&P companies. These modern techniques help minimize the risks involved in oilfield operations and are thus predicted to propel the market over the forecast period.

Regional Insights

Asia Pacific has emerged as a leading energy consumer over the last decade. The rise in energy consumption in the region is supported by the ever-increasing population, especially in China and India, which fuels the basic energy requirement for electricity, transportation, and fuel for cooking. The demand for crude oil and hydrocarbons in the region is growing due to the increasing rate of urbanization.

China has been investing four times as much as the U.S. in order to develop its shale reserves. This has created immense potential for oil & gas companies, such as Halliburton and Schlumberger, to expand. In July 2013, Schlumberger inaugurated a 32,000 square feet reservoir laboratory in Chengdu, China, to support the increasing exploration activity by providing the analysis of rock in unconventional shale plays.

Report Scope

| Attribute | Details |

| Base year for estimation | 2016 |

| Actual estimates/Historical data | 2014 - 2015 |

| Forecast period | 2017 - 2025 |

| Market representation | Revenue in USD Billion and CAGR from 2017 to 2025 |

| Regional scope | North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

| Country scope | U.S., Canada, Mexico, UK, Russia, China, Australia, Brazil, Argentina, Saudi Arabia, Algeria, South Africa |

| Report coverage | Revenue forecast, company share, competitive landscape, growth factors, and trends |

| 15% free customization scope (equivalent to 5 analyst working days) | If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization |