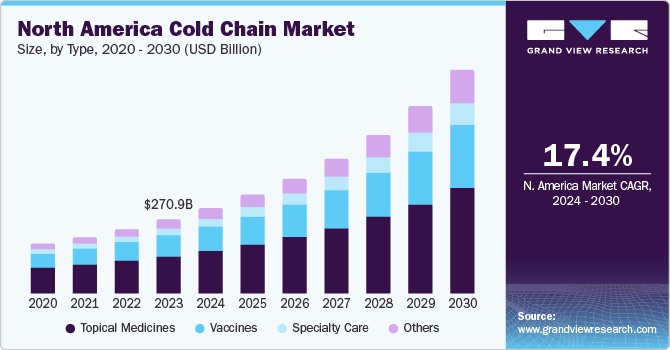

The global cold chain market size is estimated to reach USD 447.50 billion by 2025, according to a new study conducted by Grand View Research, Inc. It is anticipated to exhibit a CAGR of 15.1% during the forecast period. Technological advancements in packaging, processing, and storage of seafood products are expected to drive the growth.

Cold chain solutions have become an integral part of supply chain management for transportation and storage of temperature-sensitive products. Increasing trade of perishable products is anticipated to drive the demand for these solutions over the forecast period. Players operating in the market for cold chain are increasingly adopting alternative energy solutions such as wind and solar to minimize overall operating cost.

Among cold chain solutions, refrigeration system is used to prolong shelf life and to maintain quality of products. Refrigerants used in refrigeration systems pose a threat to the environment because of their high Global Warming Potential (GWP) and Ozone Depletion Potential (ODP).

Growing stringency of food safety regulations, such as the Food Safety Modernization Act that requires increased attention toward construction of cold storage warehouse, is slated to benefit the market. Adoption of environmental audit systems such as Leadership in Energy and Environmental Design (LEED) or Building Research Establishment Environmental Assessment Method (BREEAM) can evaluate designs at initial stage. Thus, operational performance of completed buildings can be assessed through these audit systems.

Temperature-controlled warehouses are highly energy-sensitive as they incorporate refrigeration and ventilation systems that require high power consumption. However, better design can reduce power consumption and can help build net-zero energy warehouses. Intelligent warehouse automation and control systems are one of the factors assisting buildings to achieve net-zero energy to become self-sustainable. Less energy consumption notably lowers operating expenditure, eventually contributing to protection of ecology and climate.

North America is anticipated to lead the cold chain market in terms of revenue owing to continuing innovation in autonomous trucks. Mexico is expected to witness exponential growth over the forecast period owing to the rise in investments for the development of logistics infrastructure and penetration of warehouse management systems.

In South America, Brazil is a major contributor to market growth. Implementation of dietary guidelines on usage of fresh food products over processed food led by the Brazilian government is expected to boost the market. These guidelines would necessitate development of cold chains to meet requirements for storage, transportation, and packaging of fresh food.

Key companies operating in the market include Agro Merchant Group (U.S.), Cloverleaf Cold Storage (U.S.), Henningsen Cold Storage (U.S.), Nordic Logistics and Warehousing, LLC (U.S.), and Preferred Freezer Services, LLC (U.S.). Cold chain service providers have invested aggressively to add onboard tracking equipment to refrigeration units. These units provides real-time location and temperature data to shippers and third-party logistics. It further helps them with increased visibility and opportunity to mitigate or prevent losses.

Along with the aforementioned players, cold chain packaging companies such as Cold Chain Technologies, Inc. (U.S.); Cryopack Industries, Inc. (U.S.); Creopack (Canada); and Cold Box Express, Inc. (U.S.) contribute significantly to market growth.

To request a sample copy or view summary of this report, click the link below: www.grandviewresearch.com/industry-analysis/cold-chain-market

Further key findings from the report suggest:

- Connected products help companies develop closer customer relationships through product differentiation and moving away from price competition

- Due to a shift in focus from increasing the productivity to providing better transport and storage facilities, the market has gained prominence in developing countries such as China and India

- Cold chain monitoring, smart packaging, sample lifecycle management, men and material tracking, and connected equipment are among IoT applications of key importance for the pharmaceuticals industry

- Radio Frequency Identification (RFID)-enabled supply chain provides higher efficiency and has opened up new opportunities by offering product level visibility

- Globalization and growing number of pharmaceutical and food safety counterfeit incidents have compelled governments to tighten regulations on production and supply. Rising trend of buying food products online and adoption of e-commerce in China are key demand drivers

- The Government of India remains keen on supporting development of the cold chain market and is encouraging private participation by launching subsidy schemes and offering grants.

Grand View Research has segmented the global cold chain market on the basis of type, packaging, equipment, application, and region:

Cold Chain Type Outlook (Revenue, USD Million, 2014 - 2025)

- Storage

- Warehouses

- Reefer Containers

- Transportation

- Road

- Sea

- Rail

- Air

- Monitoring components

- Hardware

- Sensors

- RFID devices

- Telematics

- Networking devices

- Software

- On-premise

- Cloud-based